The cost of living crisis: how Council Tax support can help to alleviate poverty

Council Tax support schemes in England should be reviewed in light of both the cost of living crisis and the restart of managed migration to Universal Credit. As a powerful way for local authorities to tackle poverty in their local area, Alex Clegg explores key factors councils need to consider when changing their scheme. Policy in Practice can help councils to model the cost and impact of increasing scheme generosity and take-up, and understand how managed migration will affect their schemes.

Council Tax support is a powerful tool to tackle poverty

Council Tax support (CTS) is one of the most powerful tools that local authorities in England have to tackle poverty and debt. CTS provides an ongoing rather than a one-off boost to a household’s finances, unlike much of the discretionary support that people can access through local authorities. Councils have the flexibility to design schemes that target support to vulnerable groups in their boroughs as CTS for working-age people has been devolved since 2013 and fully localised in England.

However, devolution came with a 10% drop in funding, leading many local authorities to reduce the generosity of their schemes to make savings. This has made CTS unequal across the country, both in generosity and take-up. Pensioners have been protected, benefiting from a scheme still based on the nationally set Council Tax Benefit.

The steep increase in the cost of living gives councils the opportunity to review their CTS schemes and consider how to make them more effective for the millions more households falling into poverty this year. Increasing the generosity of CTS, and making it easier to claim, can play a vital role in protecting incomes for struggling families and keeping them out of debt.

Modelling can help councils assess the cost and impact of increased generosity and potentially offset extra costs through administrative savings.

Alongside this, the ongoing migration to Universal Credit will accelerate, with the government aiming to move all working-age benefits claimants to UC by the end of 2024. The Covid-19 pandemic has already expedited migration, and local authorities dealing with the pandemic fallout had little time to consider the implications for their CTS schemes. It is now vital that councils assess how their current schemes interact with UC and whether existing objectives are still being met as the entire benefits caseload is migrated.

Two ways that Council Tax support can help alleviate poverty

There are two important ways that council tax support schemes can help to alleviate poverty:

- Increasing generosity to people most in need

- Increasing take-up so people don’t miss out

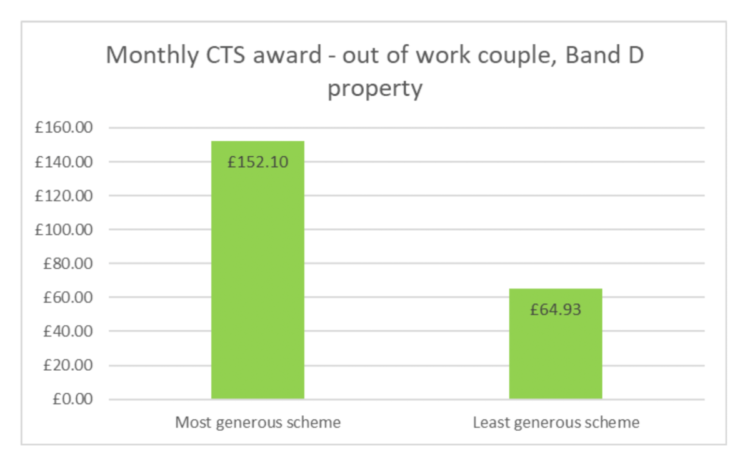

Analysis using our Better Off Calculator, which models every CTS scheme in the country, shows that the difference between the most and least generous schemes in England is worth £87 per month for an out-of-work couple living in a Band D property. This is equal to the amount of the UC uplift that had such a significant impact on poverty levels during the pandemic.

Schemes can be designed to increase generosity by, for example, increasing the maximum award percentage and/or providing higher awards for protected groups, such as lone parents, carers, households in receipt of disability benefits, or households with no income.

Around 130 councils in England currently award a maximum of 100% of council tax liability, whilst around 60 have higher awards for protected groups. This is in contrast to the least generous scheme that awards a maximum of only 50% of council tax liability.

Take-up of CTS can be increased by improving accessibility for potential claimants. Accessibility can be made easier by:

- Ensuring a clear, well-publicised and straightforward application process

- Targeting households that move to UC

- Partially automating applications for UC claimants using the Universal Credit Datashare (UCDS)

Higher costs of more generous Council Tax support schemes can be offset through administrative savings

More generous schemes and larger caseloads also mean higher costs to local authorities at a time when budgets are increasingly stretched. However, detailed modelling of future scheme options can show how increased costs can be offset by administrative savings.

For example, schemes can be designed to ensure that all claimant information required is included in the Universal Credit Datashare to prevent the need to gather information from claimants. It is also possible to reduce the need for reassessments following changes in circumstances and to align with software capabilities.

Increasing scheme generosity has been shown to reduce arrears and increase collection rates. Recent analysis carried out by Policy in Practice for a London borough showed a clear relationship between arrears and the level of Council Tax support, with those receiving the most support having the lowest Council Tax arrears and those with the greatest reduction in Council Tax support compared to the default scheme having the highest Council Tax arrears.

Having fewer households in debt is also likely to reduce the need for emergency support across other council departments.

Our analysis for the Greater London Authority in 2020 on the design of Council Tax support schemes also found a positive relationship between scheme generosity and council tax collection rates. Only scheme generosity and local poverty rates were significantly associated with collection rates, whilst council tax rates and collection practices were not.

This suggests that heavy-handed collection policies are not effective and that those who can pay will pay. Efforts should therefore be concentrated on helping those unable to pay.

Managed migration to Universal Credit could bring challenges for Council Tax support schemes

The restart of managed migration to Universal Credit from May 2022 brings up three issues for CTS that councils must consider:

- The tendency for low take-up amongst UC recipients

- Whether existing scheme objectives are met as the benefits caseload moves over to UC

- The likelihood of increased administration due to monthly changes in UC awards leading to increased CTS billing

1. Low take-up of CTS when migrating to Universal Credit

Take-up of CTS is lower for households on UC than for households on legacy benefits. This is largely due to publicity for UC stating that it merged all previous benefits, in conjunction with a potentially more complex application process.

Applying for CTS alongside UC is a two-step process. Applicants must notify the DWP as part of their UC claim that they are interested in applying for CTS. Most councils then automate the CTS claim as far as possible. As CTS is localised, each council can determine its own method of application.

To allow for automated CTS applications, many councils have amended their scheme frameworks to explicitly include the acceptance of a UC notice from DWP as an application. Where councils do not automate CTS applications alongside UC claims, the claimant will need to make a separate application.

This is in contrast to applying for CTS alongside Housing Benefit, which is often done automatically as part of the initial application. Many claimants do not know if they have to reapply when migrating to UC and some are not aware they were receiving CTS alongside legacy benefits in the first place.

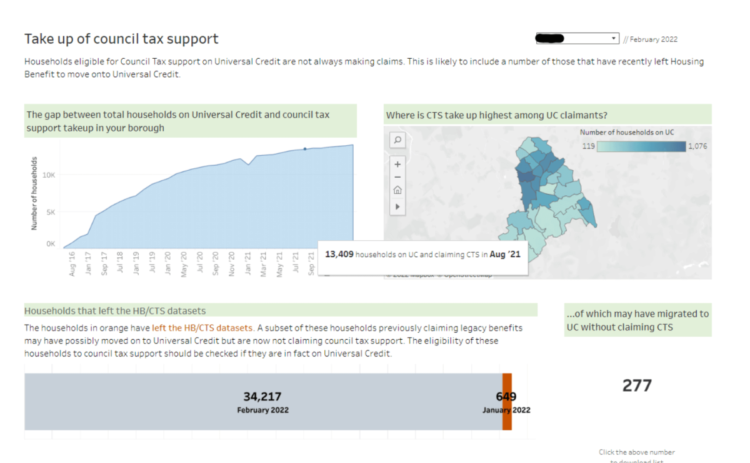

Analysis in 2021 for our Living Standards Index for London project showed a large discrepancy in CTS take-up rates amongst UC households between different London boroughs, ranging from 35% to 14%. This was largely driven by scheme generosity and councils’ efforts to make the application process simple and visible.

Local authorities can use our Low Income Family Tracker platform (LIFT) to identify and target households dropping out of the Housing Benefit and Council Tax Support datasets that may have gone on to claim UC and are not claiming CTS.

Local authorities are using these insights to design their schemes to maximise take-up of CTS by automating claims as people migrate to UC.

2. Whether scheme objectives are met as the caseload moves to Universal Credit

Doing nothing is not an option. Managed migration is likely to lead to lower awards and greater arrears if councils do not review their schemes now.

Our experience modelling CTS schemes for local authorities has shown that households on UC generally receive lower CTS than equivalent households on legacy benefits. This is due to the greater retention of earnings for UC households, different treatment for those in receipt of disability benefits, and the use of the Minimum Income Floor, which reduces support for self-employed households.

These differences will be amplified by migration to UC and local authorities should be aware of how support will change in their borough, as well as how total scheme costs will change, as migration progresses.

3. Higher administrative burden and cost

Migration to UC also has the potential to increase CTS administration for councils, as changes in monthly UC awards can lead to increased billing if they trigger subsequent changes in CTS awards. This can also lead to confusion among residents, which can in turn contribute to missed council tax payments.

This increased administrative and cost burden can be mitigated by scheme design through, for example, the introduction of banded, de minimis or discount schemes.

Four scheme options to minimise administrative costs

Local authorities aiming to make their CTS scheme more generous in the face of the cost of living crisis and the restart of managed migration will likely want to design their scheme to reduce administrative costs, in order to offset the increased costs of the scheme. Administrative savings can also be an objective in itself as councils look to minimise costs.

Four scheme options can reduce the administrative burden of CTS:

- Alignment to UC data to allow automated take-up

- Revision of the default scheme

- Income banded schemes

- Discount schemes

Scheme option 1: Alignment to UC data to allow automated take-up

Modifications can be made to existing schemes to enable councils to use the information provided in the Universal Credit Datashare to partially automate CTS take-up for those claiming UC. This has the double benefit of reducing administrative costs whilst addressing the problem of low take-up for those migrating to UC.

The following scheme characteristics can be used to help align with UC data:

- Use the UC award for all household details

- Use net income instead of gross income

- Use flat rate non-dependant deductions

- Use DWP assessment for self-employed income

- Remove special protections for DLA/PIP; use LCW, LCWRA, or Carer status as a proxy

- Exclude amount of housing costs

- Remove earnings deductions based on hours worked

With these settings in place, local authorities have the potential to process CTS claims automatically whenever a household claiming UC indicates that they are interested in applying for CTS as part of the application process. Policy in Practice is currently working with three London councils to help them move towards automated take-up in this way.

Scheme option 2: Revision of the default scheme

Local authorities that currently use the default CTS scheme can often keep their schemes cost neutral whilst modifying to increase generosity and minimise administrative costs.

Administrative savings can be made by introducing:

- Flat-rate non-dependant deductions. This removes the need to assess non-dependant income. This may give lower awards to those with low-earning non-dependants, and modelling can show any demographic groups that lose out from this change

- A minimum award. This sets a minimum threshold for a CTS award and any households whose award falls below this threshold do not receive an award. This provides savings to the council whilst only typically having a minimal impact on the highest earning households in receipt of CTS

- De-minimis rules. This stipulates that households in receipt of CTS are only required to undergo a reassessment if their income changes by more than a set threshold, thus reducing the number of reassessments

Councils can then use these administrative savings to:

- Increase their maximum CTS award

- Introduce or increase maximum awards for protected groups

- Reduce the taper rate at which the CTS award is reduced with increased earnings, so that employed households retain more of their earnings

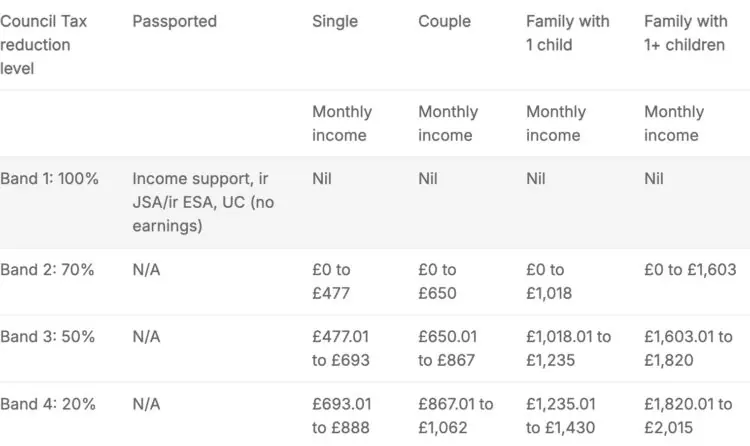

Scheme option 3: Income banded schemes

These schemes sort households into income bands, each with CTS awards based on corresponding percentages of council tax liability. Higher income thresholds are often set for larger households. These schemes generally cost less to administer than the default scheme as reassessments are only necessary when a change in circumstances causes a household to move into a different band.

Income banded schemes are also easier for potential claimants to understand and may therefore help to boost take-up.

Modelling can help design schemes that:

- Reflect software capabilities

- Reverse engineer income bands, and levels of discount for each, to keep schemes cost-neutral or to make savings

- Can support automation

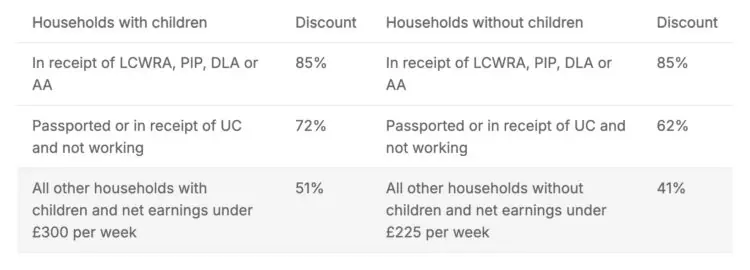

Scheme option 4: Discount schemes

Discount schemes give discounts on council tax liability based on household type rather than income, with eligibility determined by criteria such as benefit receipt or a maximum income. This removes the need to assess claimants’ income, significantly reducing administration. They are also simple for claimants to understand and may help to boost take-up.

An example of a discount scheme, which uses disability benefit receipt, being out of work and a maximum income threshold as eligibility criteria

It should be noted that some councils consider income banded and discount schemes to be unfair due to their lack of nuance in taking into account the financial situation of different households. In this regard, there is a trade-off between the precision of awards and the simplicity of the scheme that councils must weigh up when choosing to change to one of these types of schemes.

How modelling CTR schemes can help tackle the cost of living crisis

Local authorities looking to make a change to their CTS scheme need to understand the costs of changes and the expected impact on their residents.

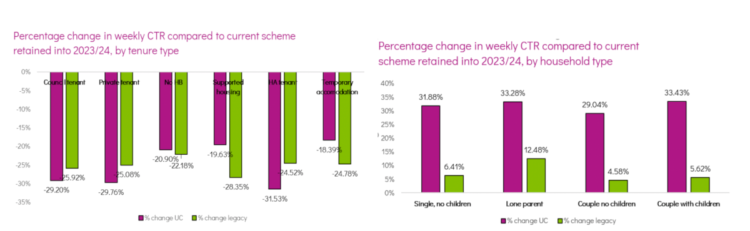

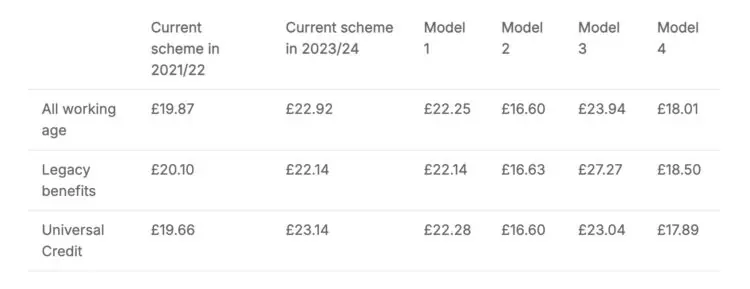

Our CTS modelling shows the full cost to the council of all the modelled options and the cost of retaining the current scheme into the year to be modelled, taking into account the expected level of UC migration. It also calculates the average awards and impacts compared to retention of the current scheme for households on UC and legacy benefits, broken down by key demographics.

Outputs from our CTS modelling, showing average awards and impact on demographic groups for different models

This enables councils to use their knowledge of local poverty patterns to target demographics in their borough that they know to be struggling or have high arrears. In the context of managed migration, modelling can reveal whether households will gain or lose support as they migrate to UC.

This data is essential not just to design the final scheme but also to inform decision making for council members, council budgets and public consultations.

Councils can use their Council Tax support schemes to help people through the cost of living crisis

In summary, now is an essential time for local authorities to review their current CTS schemes to understand how they alleviate poverty in the face of the cost of living crisis, and how they interact with UC in the context of managed migration over the next two years.

Policy in Practice’s CTS modelling is tailored to each council we work with, taking into account a range of factors including local policies and commitments, cost requirements, administration and demographic impact.

For more information contact hello@policyinpractice.co.uk or call 0330 088 9242.