We empower people

Practice

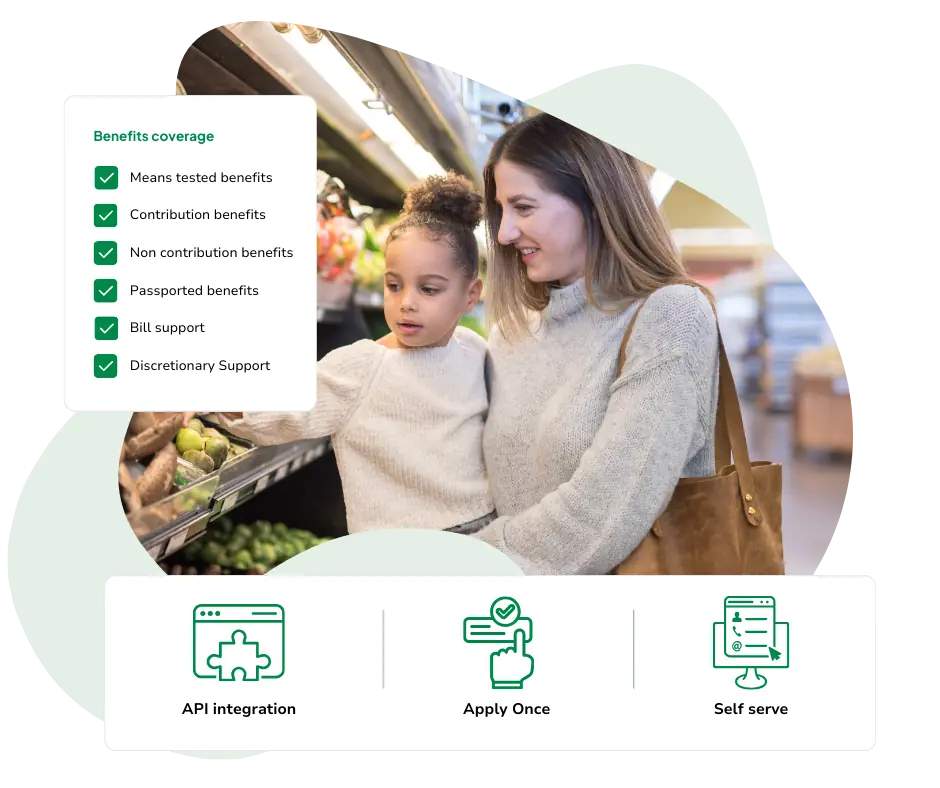

Smart products help our clients efficiently close this support gap

View our Better Off platform

Who we work with

Local authorities

Local authorities combine our analytics with their data to tackle vulnerability and improve lives

Learn more

Sector partners

Housing providers, utilities, finance sector organisations and charities use our software to empower customers

Learn more

Policymakers

Policymakers use our policy expertise to drive improvements across the public sector

Learn more

Individuals

People use our free Better Off Calculator, the smartest available, to identify and claim support

Learn more