Report

Cheques and imbalances: How income varies throughout the year for Universal Credit households

Executive summary

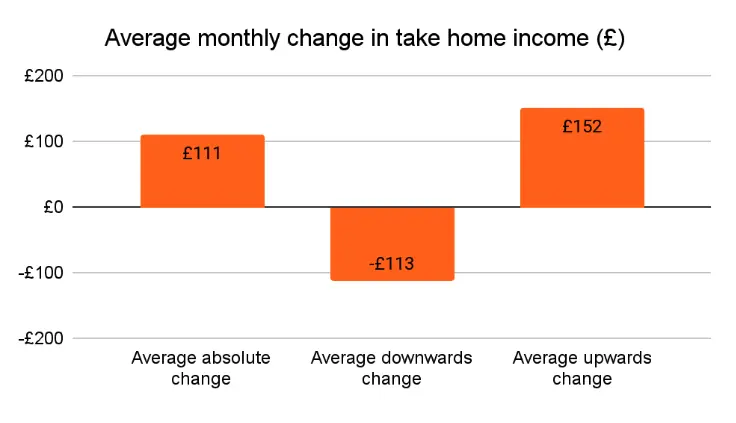

Income volatility can have serious consequences for low income families on Universal Credit, affecting their ability to budget and plan ahead. When earnings fluctuate from month to month, even small changes can impact household budgets and benefit awards, and the way councils handle administration and billing.

Volatile income makes it difficult to budget which means that families are at higher risk of falling into problem debt and financial difficulty. Financial instability takes up mental bandwidth and is linked to poorer physical and mental health outcomes, while increasing the poverty premium by, for example, making it harder to pay by direct debit.

In a new study, funded by the Joseph Rowntree Foundation, we show the level of income volatility faced by a subset of households receiving Universal Credit.

- Almost a third of Universal Credit households experience income volatility

- Universal Credit dampens earnings volatility for working households, sanctions and deductions exacerbate income volatility and leave households worse off

- Income volatility for Universal Credit recipients can impact entitlement to other benefits and eligibility for local support

Having income that changes from one month to the next makes it much harder to budget and plan ahead. Our new report on income volatility provides clear analysis to help people better predict their next Universal Credit payment while also highlighting key issues for policymakers. One of the most striking findings is just how much deductions contribute to income instability and how frequently people gain or lose access to passported benefits within a single year. The report sets out sensible, low cost steps the government can take to ensure Universal Credit remains simple in both policy and practice.

Universal Credit was designed to boost work incentives for people. Over a decade after its launch, this study explores the extent to which UC makes fluctuating work pay. Our analysis shows that one in three working households on UC face a significant change in income at least one month in a year. This has knock on effects for their eligibility for other national and local schemes to help with food costs, prescriptions and council tax which, in turn, weakens households' financial resilience and wellbeing while adding pressure to council's ability to support working residents.