New analysis: How income varies throughout the year for Universal Credit households

Income volatility can have serious consequences for low income families on Universal Credit, affecting their ability to budget and plan. When earnings fluctuate from month to month, even small changes can impact household budgets and benefit awards, and the way councils handle administration and billing.

Volatile income makes budgeting difficult, which means that families are at higher risk of falling into problem debt and financial difficulty. Financial instability takes up mental bandwidth and is linked to poorer physical and mental health outcomes. It also increases the poverty premium by, for example, making it harder to pay by direct debit.

In a new study funded by the Joseph Rowntree Foundation, we show the level of income volatility faced by a subset of households receiving Universal Credit.

By following over 70,000 Universal Credit households across seven local authorities from April 2022 to March 2023, we find that:

- Almost a third of Universal Credit households experience income volatility

- Universal Credit dampens earnings volatility for working households, sanctions and deductions exacerbate income volatility and leave households worse off

- Income volatility for Universal Credit recipients can impact entitlement to other benefits and eligibility for local support

Having income that changes from one month to the next makes it much harder to budget and plan ahead. Our new report on income volatility provides clear analysis to help people better predict their next Universal Credit payment while also highlighting key issues for policymakers. One of the most striking findings is just how much deductions contribute to income instability and how frequently people gain or lose access to passported benefits within a single year. The report sets out sensible, low cost steps the government can take to ensure Universal Credit remains simple in both policy and practice.

Deven Ghelani, Policy in Practice

Our findings, in depth

1. Almost a third of Universal Credit households experience income volatility

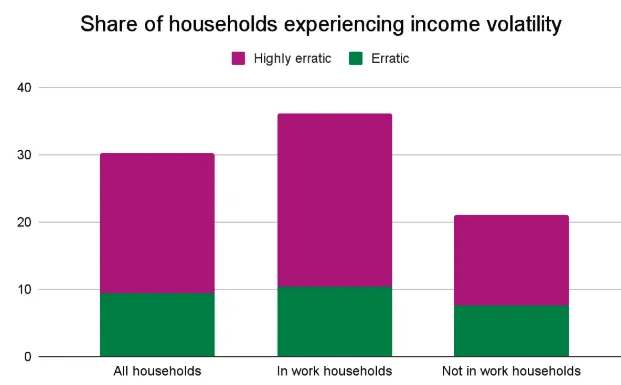

- 30% of Universal Credit households experienced at least one month where their take home income changed. This rises to 36% for working households, and 21% for households with no earnings

- One in five households (21%) have highly erratic incomes, where income changes are more frequent. People under 25, single people, Londoners and higher earners are most likely to experience income volatility whether in or out of work

2. Universal Credit dampens earnings volatility for working households, sanctions and deductions exacerbate income volatility and leave households worse off

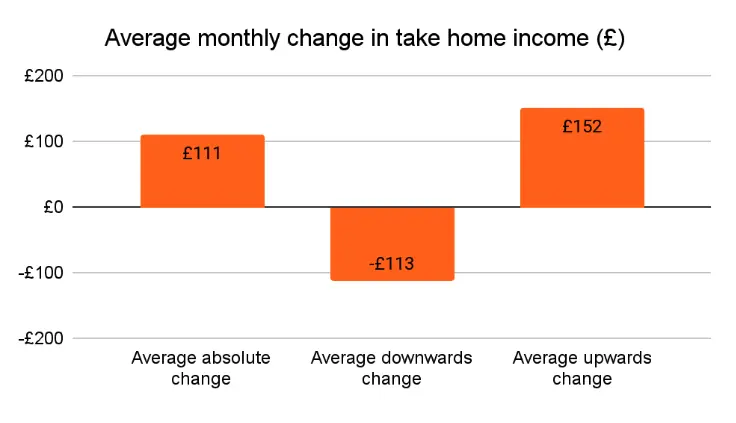

- Income fluctuates by £111 per month on average per working household. Universal Credit dampens earnings volatility of £161 per month by half, bringing the average size (£) of income fluctuations down to £73 after the UC taper has been applied. However, sanctions and deductions increase volatility to £111.

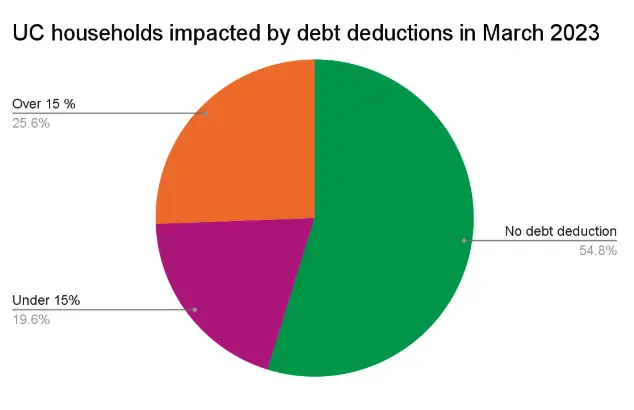

- Recent changes to the debt deduction cap are welcome. Our modelling shows that this is expected to help 26% of households, based on our sample of Universal Credit recipients.

This chart shows the percentage of households impacted by different levels of debt deductions while on Universal Credit. One in four households lose 15% or more of their standard allowance due to debt reductions

3. Income volatility for Universal Credit recipients can impact entitlement to other benefits and eligibility for local support

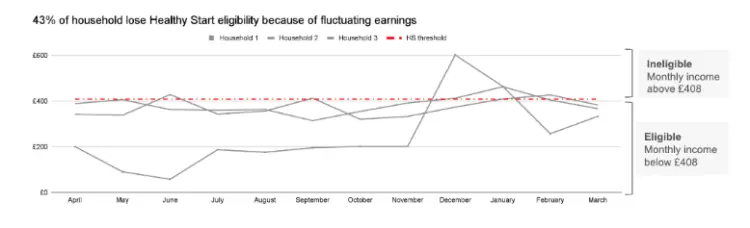

- Fluctuating earnings can mean fluctuating entitlements to passported benefits, such as Healthy Start and free NHS prescriptions. Free School Meal (FSM) entitlement is also impacted by fluctuating earnings, but entitlement is not lost because currently earnings are assessed over a number of assessment periods, and eligibility continues until the end of the child’s current phase of education

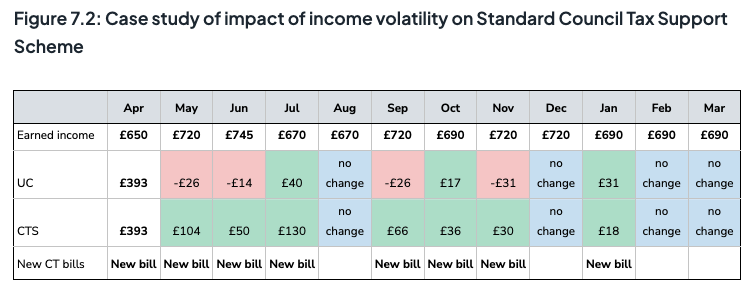

- Income volatility also impacts eligibility for local support and the costs of collection. Council tax support schemes can require a reassessment for each change in earnings. This can mean a new bill is issued every month, leading to confusion for taxpayers and additional costs such as postage, estimated at an extra £16 million per year, with other costs including extra staffing, administration, arrears and collection expected to be at least as large

Kevin’s earnings pattern, when combined with his council’s CTS scheme, means he will receive eight Council Tax bills this year. Each bill will outline new instalment dates, with different amounts

Four recommendations to combat income volatility

- The government should prioritise efforts to mitigate the impact of sanctions and deductions to reduce income volatility

- The government should increase the Universal Credit Standard Allowance alongside introducing a work allowance for under 25s and people without children, as they are most at risk of income volatility

- The government should introduce delayed termination of passported benefits. This would dampen the impact of earnings volatility onto passported support and encourage take up

- Councils should introduce income banded and Universal Credit aligned Council Tax Support schemes to lower administration costs. Additional data from DWP covering more households on Universal can support further automation of schemes for households in work

Universal Credit was designed to boost work incentives for people. Over a decade after its launch, this study explores the extent to which UC makes fluctuating work pay. Our analysis shows that one in three working households on UC face a significant change in income at least one month in a year. This has knock on effects for their eligibility for other national and local schemes to help with food costs, prescriptions and council tax which, in turn, weakens households’ financial resilience and wellbeing while adding pressure to councils’ ability to support working residents.

Tylor Maria Johnson, Policy in Practice

Join our free webinars

- The efficiency imperative: driving impact via data driven outreach on Wednesday 26 March. Details and registration here

- Protecting vulnerable consumers in regulated sectors on Wednesday 30 April. Register here

- Harnessing data for regional impact: empowering local leaders to drive change on Wednesday 21 May. Details and register here