New analysis: Financial resilience and the transition to Universal Credit

Policy in Practice publishes new analysis on the transition to Universal Credit today, thanks to support from the Joseph Rowntree Foundation.

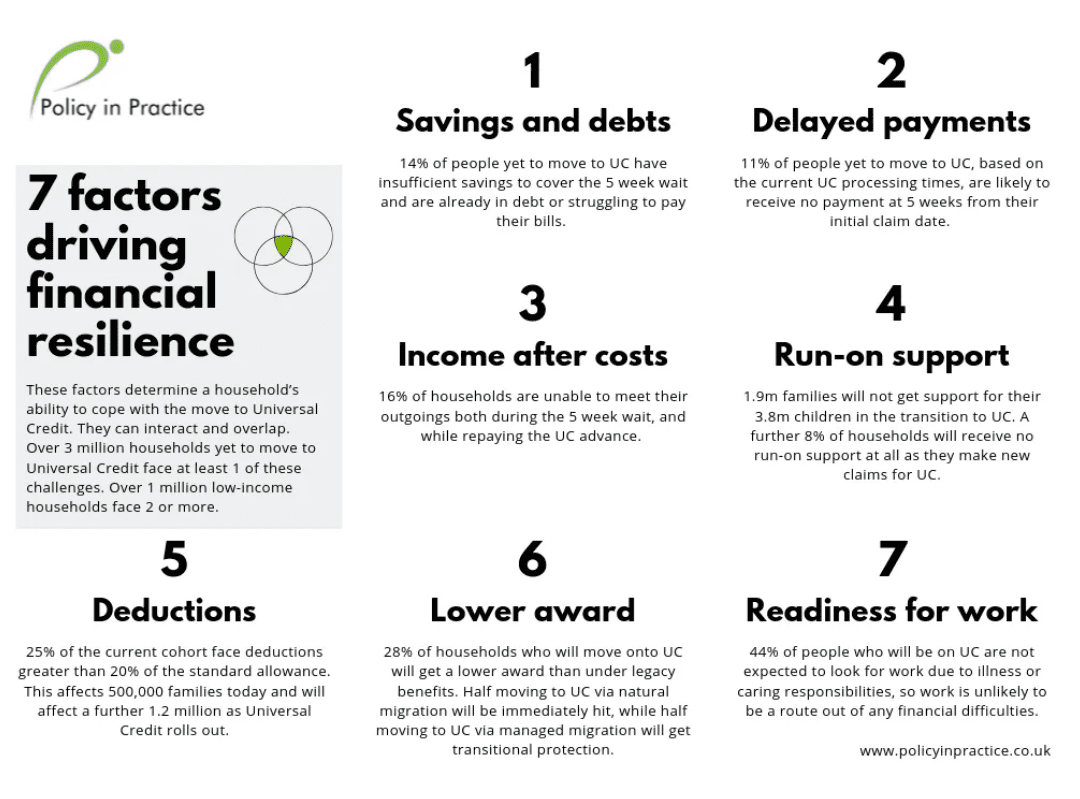

New analysis from Policy in Practice finds 7 factors that determine whether families will cope with the move to Universal Credit

We identify seven factors that determine a household’s ability to cope with the transition to Universal Credit. These can often interact and overlap; at least 3.3 million households, or 71% of the cohort yet to move to Universal Credit, will face at least one of these challenges, and at least 1.2 million low-income households, around 26% of the cohort yet to move onto Universal Credit, will face two or more of these challenges.

4 ways to help households transition to Universal Credit

Our analysis shows that it is possible for the DWP to identify these pressure points, and to act proactively to prevent hardship and ease the transition to Universal Credit. We therefore recommend that as a matter of priority the Government should now introduce:

- A targeted grant in place of the Universal Credit advance payment for those households clearly struggling because of the transition to Universal Credit;

- A two-week run-on of Child Tax Credit, paid through the Universal Credit system, to help families with children;

- Fortnightly payments of Universal Credit, starting with an initial payment at two weeks based on the estimated monthly award amount.

- Greater flexibility in processes such as the recovery of overpayments and advances, claim verification and backdating, as called for by claimants, to help people to manage the transition to Universal Credit.

The analysis supports new research by the Trussell Trust, showing that, in areas where Universal Credit has been rolled out for at least a year, food banks in their network have seen a 30% increase in demand.

Download Policy in Practice’s Universal Credit and Financial Resilience report:

- Full report here (with full technical appendix)

- Summary report here (without full technical appendix)

Background and context to the report

This new analysis takes into account the range of challenges people face alongside recent improvements to identify how many people are likely to continue to struggle with the transition to Universal Credit.

We speak with people in receipt of Universal Credit to understand their biggest challenges, and what could help them to stay afloat. We then go onto model the transition onto Universal Credit across the population.

We then go on to model a range of policy options to ease the transition onto Universal Credit before making recommendations for the government to consider.

7 factors determining financial resilience

- Savings and Debts: 14% of people yet to move to Universal Credit have insufficient savings to cover the five week wait and are already in debt or struggling to pay their bills before they move to Universal Credit. This represents 700,000 households yet to move to Universal Credit.

-

Delays in payments: 11% of people yet to move onto Universal Credit, based on the current Universal Credit processing times, are likely to receive no payment at five weeks from their initial claim date. This represents 500,000 households yet to move to Universal Credit.

-

Income after costs: 16% of households are unable to meet their outgoings both during the five week wait, and while repaying the Universal Credit advance. This represents 740,000 households. A further 25% of households face an income shortfall during the five week wait and return to surplus afterwards, this represents 1.3 million households.

-

Run-on support: Households will not get run-on support for their children through Child Tax Credit, this represents 1.9m families and 3.8m children. A further 8% of households will receive no run-on support at all as they make new claims for Universal Credit.

-

Deductions from Universal Credit: 25% of the current cohort face deductions greater than 20% of the standard allowance, this affects 500,000 families today, and will affect a further 1.2 million households as Universal Credit rolls out.

- A lower award amount under Universal Credit: 28% of households who will move onto Universal Credit are eligible for a lower award than under legacy benefits. This represents 1.3 million households. Of these, 700,000 households moving to Universal Credit through natural migration will be immediately impacted, while 600,000 households expected to move to Universal Credit through managed migration will initially receive transitional protection.

- Work-ready: 44% of the Universal Credit cohort are not expected to look for work due to illness or caring responsibilities, meaning that work is unlikely to be a route out of any of the financial difficulties they may face.

Deven Ghelani, the Director of Policy in Practice and one of the architects of Universal Credit said:

“The evidence shows that while Universal Credit is improving, many households will still struggle with the transition.

“With over 4 million households yet to move onto the new benefit, families facing multiple challenges, such as having no savings, facing delayed payments, and getting a lower award on Universal Credit will need additional support.

“The important point is that these households can be identified in advance and hardship prevented if they get targeted support to manage the move onto the new benefit. Universal Credit then becomes a better platform on which to build than the legacy system it replaces.”

The types of households that will struggle to transition well to Universal Credit

The report fully recognises many of the encouraging changes and improvements to Universal Credit. Against this generally encouraging background, our analysis clearly shows that the transition to Universal Credit presents major problems for a significant number of claimants.

Households that will struggle with the transition to Universal Credit tend to:

- be in debt before making their Universal Credit claim, compounding their need for an advance payment which they then have to repay

- experience a delay of longer than five weeks before receiving their first Universal Credit payment

- find that their Universal Credit entitlement is lower than the support they were used to receiving under legacy benefits

Many are not expected to look for work, which means that they have limited ability to increase their income to escape the difficulties caused by the transition to Universal Credit.

In these circumstances, certain features of Universal Credit need to be redesigned to focus available help and resources on supporting these households to steer clear of poverty. We also show that it’s possible for DWP to identify households affected by multiple challenges in advance of their transition to Universal Credit, and how this can be the basis for targeted interventions. This short video shows how Croydon Council is taking this preventative approach to support now.

Download our research

- Full report (with full technical appendix) here

- Summary report (without full technical appendix) here

- Media release here

Join our next webinars

- Wednesday 23 October: How to target your Discretionary Housing Payments well

- Wednesday 13 November: Designing effective data-led intervention campaigns

- Wednesday 11 December: Lesson learned: our year modelling Council Tax Reduction Schemes

- Wednesday 15 January: Designing effective data-led local authorities