CTR Schemes – benefiting councils or residents?

A recent briefing by the New Policy Institute (Council tax support schemes in 2017-18: what are the key issues ahead of councils’ decisions?, 25 January 2017) reflects some of the key issues that have arisen through our conversations with councils and through the data analysis undertaken in order to model CTR schemes for those councils.

According to NPI the key issues facing local authorities when creating their next council tax support schemes are threefold. They argue that councils need to consider whether minimum payments for working-age claimants will continue to rise; secondly councils need to keep up with the changes made to other benefits (such as the removal of the Family Element for housing benefit) and, finally, councils should consider whether to introduce more radical changes to their CTR schemes.

How Policy in Practice helps councils model CTR schemes

At Policy in Practice we have used council data to model the financial and social impacts of numerous proposed council tax reduction (CTR) schemes and our work supports the key messages of NPI’s briefing.

We have modelled over 58 scheme options for councils to consider, identifying scheme savings of £24 million and administration savings of £5 million. Most importantly, we have sought to protect nearly 400,000 low income households.

In it’s briefing, NPI suggests three questions for councils to consider when deciding future CTR schemes, namely:

- In setting these schemes, has sufficient regard been paid to the extent to which low-income residents are able to afford further increases in the amount of council tax they are required to pay?

- Have the consequences of further reductions in generosity for their schemes been considered? research shows that harsher schemes are associated with higher increases in arrears and difficulty in collecting (from the council’s perspective) small amounts of money from low income residents.

- For councils considering more radical departures from the CTB scheme template, are there mechanisms in place to monitor the effects of these in terms of a) whether the amounts are appropriate and b) how it is interacting with other benefits and incentives?

We routinely cover the questions NPI rightly raise, though not all local authorities want to model arrears or affordability. We show councils how their proposed CTR schemes interact with other benefit changes by modelling future welfare changes, the cumulative impact, on different groups. We clearly show the impact of proposed schemes which enables council Members to then consider issues of fairness and appropriateness.

Managing costs is a key driver

At Policy in Practice we have used council data to model the financial and social impacts of numerous proposed council tax reduction (CTR) schemes and our work supports the key messages of the briefing.

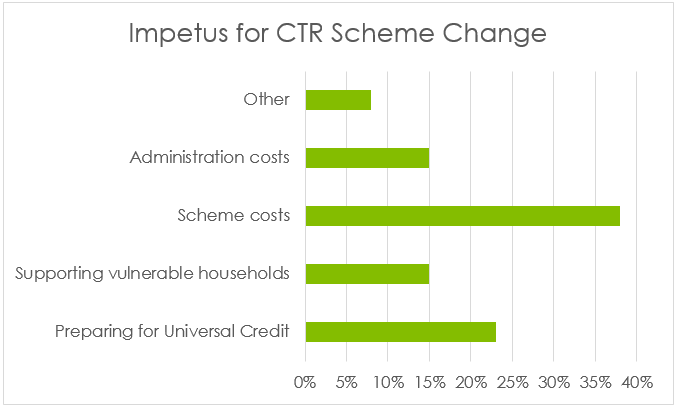

In particular, we find that managing cost within strict budgets is a primary consideration for councils. Indeed, a poll taken at a recent Policy in Practice online seminar on CTR schemes showed that cost consideration is the key impetus for scheme change.

The importance placed by councils on preparedness for Universal Credit reflects comments made by NPI. They note the haphazard way in which national welfare support changes affect local schemes; either in their impacts on the population or through the council attempting to incorporate housing benefit changes into CTR schemes.

The importance placed by councils on preparedness for Universal Credit reflects comments made by NPI. They note the haphazard way in which national welfare support changes affect local schemes; either in their impacts on the population or through the council attempting to incorporate housing benefit changes into CTR schemes.

Who’s benefiting most from CTR scheme redesigns?

However, some authorities are using the imposition of welfare benefit changes, in particular the roll-out of Universal Credit, as the driver for scheme change in a manner that will be advantageous to the council.

Some councils are seeking to benefit from the complex assessment of needs and income being undertaken for Universal Credit purposes and to ensure that means-tested assessment is not replicated within the council.

Secondly, councils are seeking to reduce administration costs and thereby limit any savings that may be required from Council Tax support. To put these savings in context we have used DWP research on the cost of claim administration, and found that the cost of administration of default-scheme Council Tax support (as standalone claims) can typically range from 15% to 35% of total CT support cost.

This objective recognises that, as responsibility for assessment of housing costs moves to Universal Credit, the subsidy received by councils for CTR administration will not replace the subsidy received for housing benefit administration. In this way, councils are left to shoulder the burden of the administration of their scheme.

Modelling for Universal Credit alongside existing schemes

We have noted that many of the councils for whom we have modelled scheme options have requested that we include both changes to current schemes AND modelling of schemes in preparation for Universal Credit. By examining both these options, councils are in a strong position to increase savings in the short term whilst they introduce a long-term solution.

Schemes that fit alongside Universal Credit fall into two main types; banded schemes and flat discount schemes. Both these schemes can be adjusted to fit with local objectives and policies. Most importantly, both can be designed to require minimal assessment by the council.

Schemes that fit alongside Universal Credit fall into two main types; banded schemes and flat discount schemes. Both these schemes can be adjusted to fit with local objectives and policies. Most importantly, both can be designed to require minimal assessment by the council.

3 important administration considerations

However, in the world of benefit and support nothing is simple, and with this move towards aligning schemes with Universal Credit, some additional administration issues require consideration;

- What is the best timing of a complete scheme overhaul? Councils need to consider whether to introduce new schemes to UC claimants only, or as a “big bang” approach.

- Do cost savings need to be made on current schemes that work alongside schemes to be introduced for UC claimants? In which case, financial and social impact assessments may be required for both amendments to current schemes (in order to realise these savings) and for Universal Credit schemes. Our experience is that this “dual preparation” approach is the most popular.

- How will Councils realise possible administrative savings given that UC may change monthly? Authorities we have been working with have been considering various methods to reduce reassessments including de minimis rules, averaging UC income, and fixed award periods.

Modelling the impact on communities is critical

The conclusions reached by NPI of the wider consideration for scheme changes sits alongside these administrative considerations. NPI urges councils to understand the impact of change on the community, have an awareness of the effects on arrears and collection and an awareness of interaction with other welfare changes. All these are key to developing a scheme that is fair to different sections of the population and that work with the local demography, local anti-poverty strategies and other local policies.

Policy in Practice’s modelling of CTR schemes provides data-led evidence to facilitate this scheme change. The consideration of impacts is vital for member support and to ensure that schemes do not cut across other strategic objectives. To this end, we provide impact assessments by household composition, economic situation, tenure, and CT band and provide analysis around specific local strategies.

For many authorities, we also model impacts on arrears and collection rates. Most importantly, our modelling process takes account of all foreseeable welfare and wider changes (such as changes in tax thresholds and CT rises). This provides the authority with a rounded picture of impacts and enables the council to have the evidence they require for both member-led decisions and public consultation.

Find out more

- Read How to raise Council Tax and keep members happy

- View details of our Council Tax Reduction Scheme modelling service

- Request an existing client’s CTRS modelling report* here

*We have permission from existing clients to share their reports with other local authorities who may be similar in structure, demographics or strategic vision to your council.