In late 2020 East Riding of Yorkshire Council had arrears worth over £3.2 million:

- Over £2 million in council tax arrears

- Over £960,000 in housing benefit overpayments

- Over £252,000 in rent arrears

At the same time, 42% of residents were living below the poverty line.

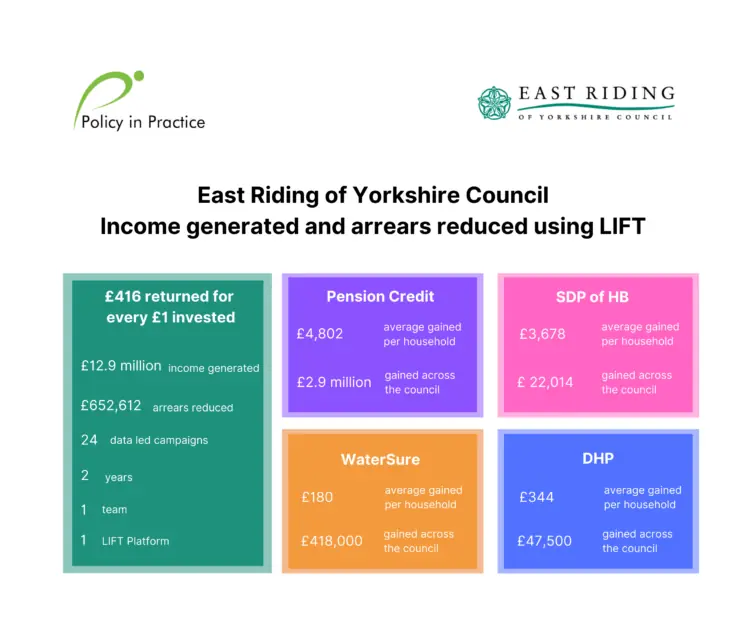

Directed by its Financial Inclusion Strategy the council sought to increase the financial resilience of residents by targeting support to people in arrears, and encouraging the take up of unclaimed benefits, social tariffs and related support.

However, in order to put their plans into practice, they needed to generate impact without placing extra administrative strain on staff. This needed to be done whilst also managing demand for other council services and administering the government’s COVID response grants for households and businesses.