test, test, test, test

Report

Spring Budget 2024: Marginal tax rates improved for low earners and families but more to do

Read the full report

Spring Budget 2024: Marginal tax rates improved for low earners and families but more to do

The Chancellor should have gone further and abolished the High Income Child Benefit Charge altogether as some families still lose half their money.

A year ago this month Policy in Practice called for the removal of the High Income Child Benefit Charge in our report Putting the Universal in Universal Credit. In this month’s Spring Budget, action was finally taken to address this decade-old policy.

Last year’s report found that the combined impact of Income Tax, National Insurance, the High Income Child Benefit Charge, and support for housing and childcare under Universal Credit can mean that some households face effective marginal tax rates (EMTRs) of 90% or more (Ghelani, Clegg, Bahia, and Charlesworth, 2023).

In our research we found that taxes, benefit taper rates, and passported benefits and services, can mean that middle and low income families with children face disproportionately high effective marginal tax rates compared to the higher earners without children.

We called for more to be done to ensure that the tax and benefit system is simple and progressive, rather than punitive.

12 months on and new analysis from Policy in Practice shows that the Chancellor’s 2024 Spring Budget improves work incentives for low and middle income families.

Our analysis finds that:

- Marginal Tax rates will be 1.8% lower for lower and middle income earners on Universal Credit because of a fall in National Insurance from 12% in April 2023 to 8% from April 2024

- The biggest falls in effective marginal tax rates are delivered through changes to the HighIncome Child Benefit Charge (HICBC) for families earning between £50,000 to £80,000 with children

The Chancellor’s changes improve marginal tax rates for middle earners, but high effective marginal tax rates still mean work won’t pay much at all for families with children on £60,000 to £80,000. The Chancellor should have gone further and abolished the High Income Child Benefit Charge, as support for children should be universal, and some families will still face punitive effective tax rates of 89%.

Deven Ghelani, Director and Founder, Policy in Practice

Spring Budget 2024 improved work incentives for low and middle income families

This week’s Spring Budget announced two policies to improve the tax burden on low and middle income families.

First, National Insurance will be cut by another 2p from April 2024. This is expected to save more than 27 million workers an average of £450 a year. Combined with January’s 2p National Insurance cut, the average earner on £35,000 will save up to £900 a year. This means that people earning below £50,000 will get to keep more of the income they earn. In a cost of living crisis, every little helps.

Second, the threshold for the High Income Child Benefit Charge will rise from £50,000 to £60,000 and will withdraw Child Benefit at half the rate of the previous taper for people earning between £60,000 to £80,000. This means that families with children that had been impacted by the High Income Child Benefit Charge will see their incomes increase provided both parents (or one single parent) earn below £80,000.

These are positive steps made by the Chancellor and we recognise the government’s efforts to make the tax system fairer, especially for families.

But we think the Chancellor could, and should have gone further by abolishing the High Income Child Benefit Charge altogether, and increasing Universal Credit allowances rather than lowering taxes. This would go further to help families on low incomes whether in or out of work.

Marginal Tax rates are 1.8% lower for people on Universal Credit because of a fall in National Insurance from 12% in 2023 to 8% from April 2024

Effective marginal tax rates (EMTR) represent the percentage of an additional pound of income that is paid in taxes. In plain terms, it highlights the amount a person gets to keep as they earn more money.

So, if your EMTR is 68%, it means that for every extra pound you earn, 68 pence will be paid in taxes, or in lower benefit payments.

Understanding EMTRs helps individuals make informed decisions about things like working more hours, taking on additional work, as it shows how taxes impact overall income.

We find that lower and middle income earners will see their marginal tax rates go down by 1.8% because of the 4p cut to National Insurance.

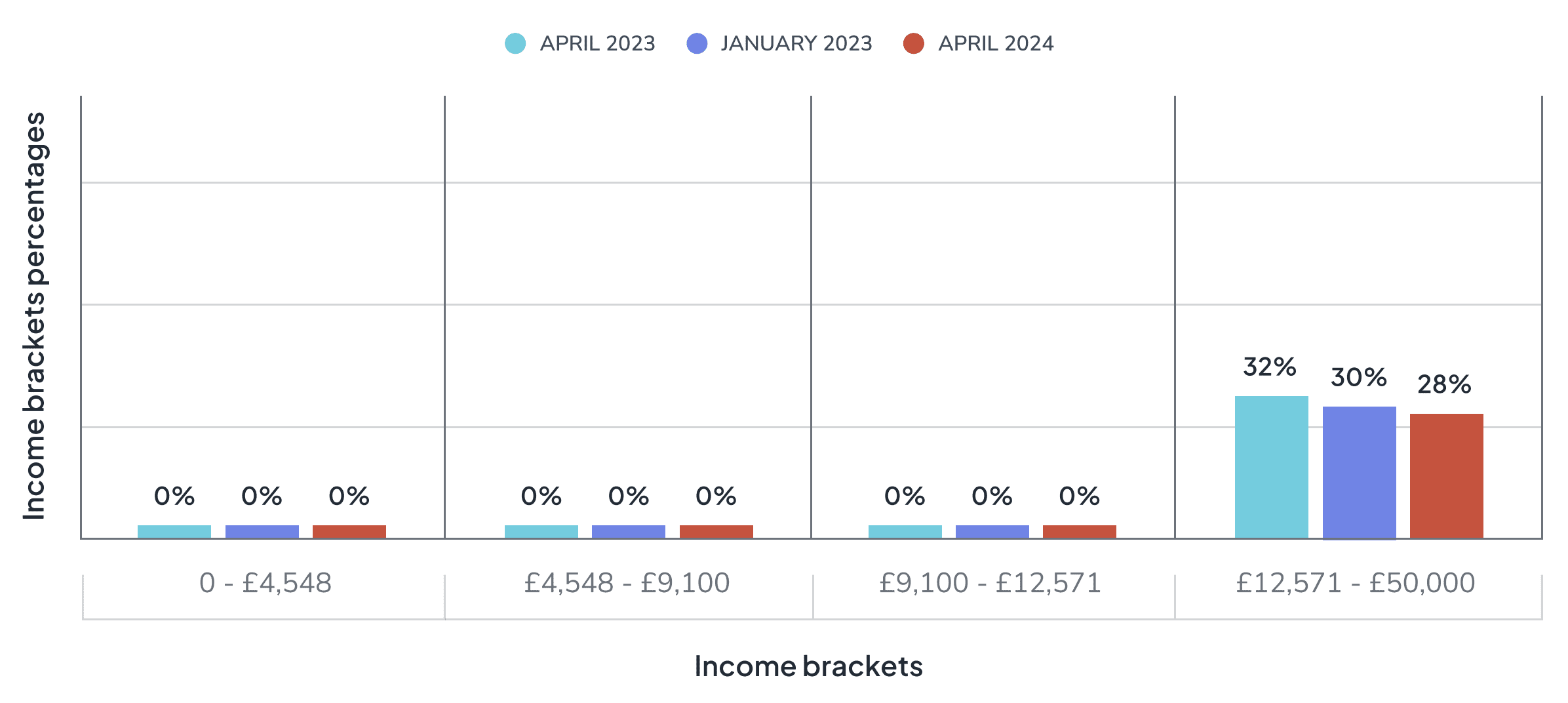

Chart 1 below shows the marginal tax rate for a lone parent household with two children, not receiving Universal Credit.

When the lone parent in this example earns above £12,570, she will get to keep an additional 4p for every £1 that she earns. This is a substantial tax cut. This cut also means that a household with a single earner making £35,000 a year will be £897.20 better off. But, if the same parent is receiving Universal Credit, she will see most of her income clawed back

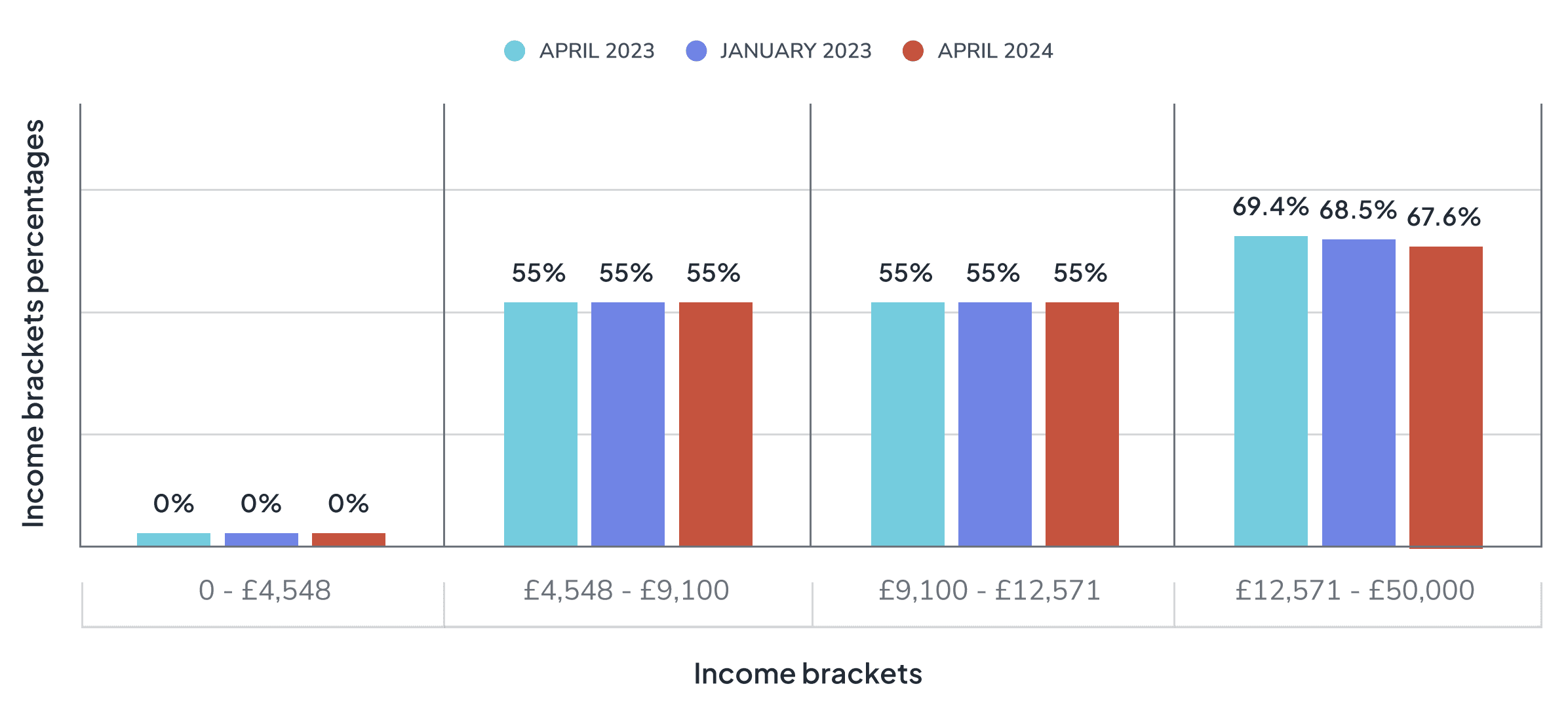

In Chart 2, below, our lone parent will still be £403.74 better off as a result of the fall in National Insurance, but because Universal Credit is withdrawn at a rate of 55% of net earnings, the government will see £493.46 returned to it in lower Universal Credit payments.

The biggest falls in effective marginal tax rates are delivered through changes to the High Income Child Benefit Charge (HICBC) for families with children, earning between £50,000 to £80,000.

We called on the Chancellor to lower punitive effective marginal tax rates in 2023. In yesterday’s Spring Budget, the Chancellor helped families with children earning between £50,000 and £80,000 by raising the HICBC threshold and withdrawing Child Benefit at half the rate of the previous policy.

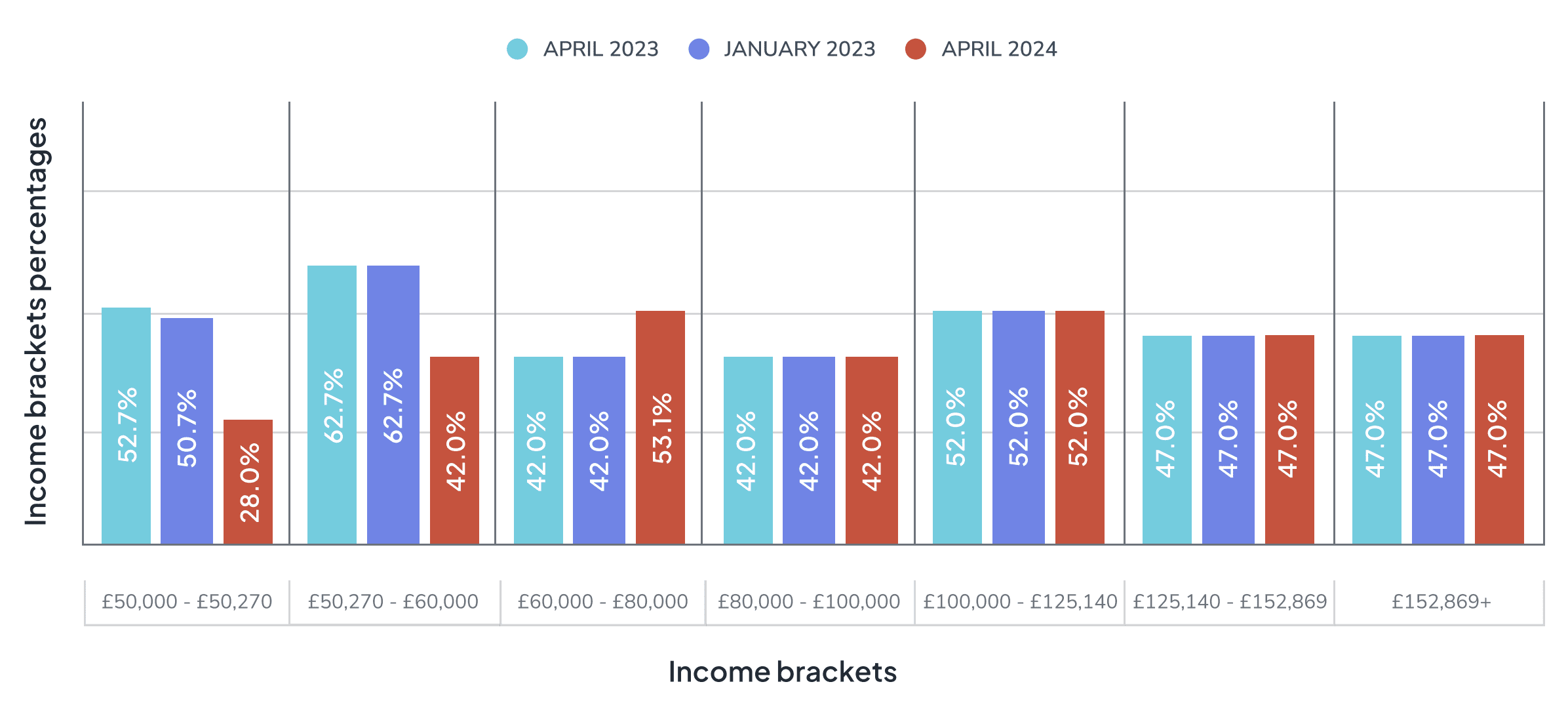

Chart 3, below, shows what this means for a family with two children.

When one parent earns between £50,000 to £60,000, they will see a substantial fall in their marginal tax rate.

This is because the government will begin to withdraw Child Benefit when one parent earns £60,000, a step up from the previous £50,000 threshold. This means that a household with a single earner making £60,000 a year will be £2,200 better off because of the raising of the HICBC threshold.

Families with children earning between £60,000 and £80,000 will see an increase in their effective marginal tax rate, but this is because they now receive some Child Benefit, whereas previously Child Benefit was reduced to zero when one parent’s earnings hit £60,000 a year.

The chancellor tackled punitive EMTRs where working more could leave people worse off

For families on Universal Credit earning above £50,000, the falls in marginal tax rates are almost as steep.

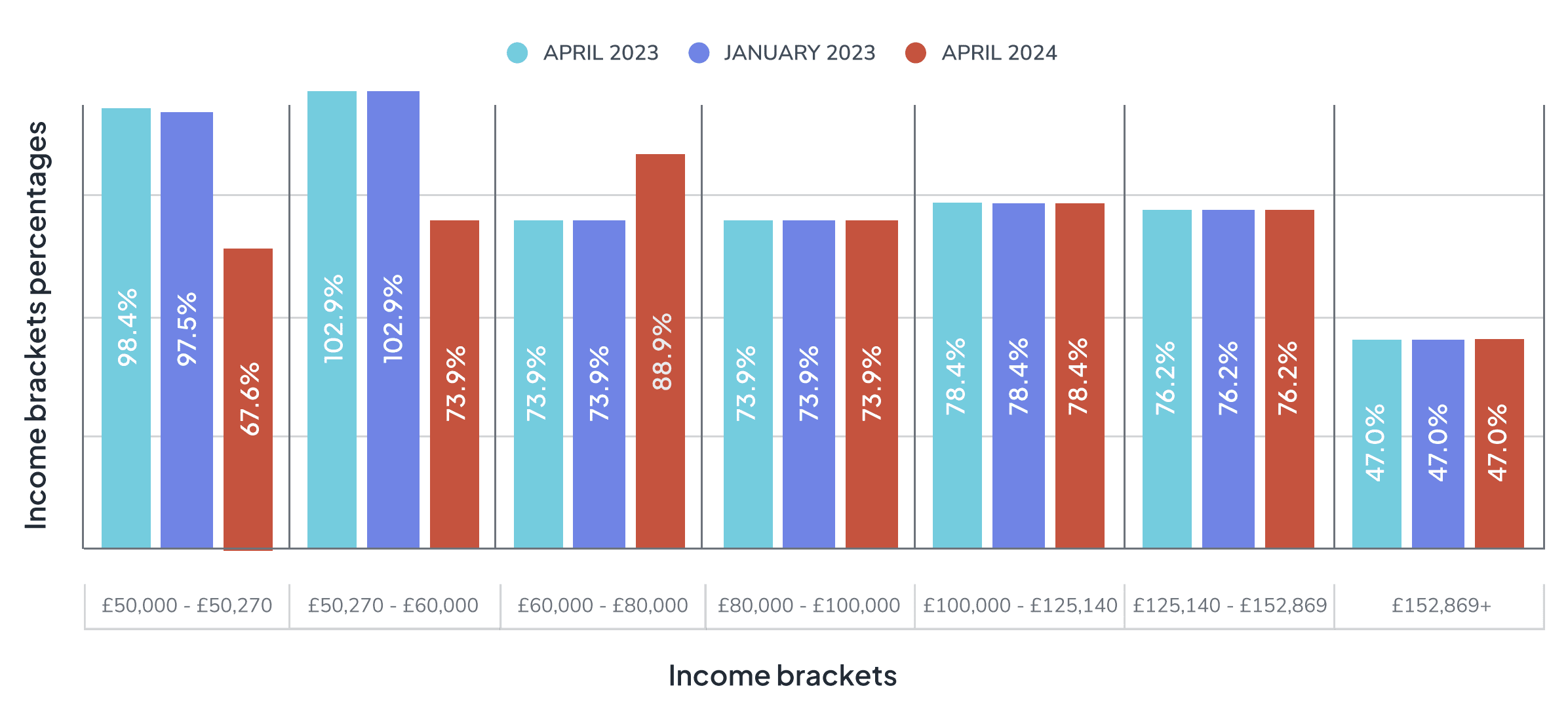

In our 2023 report, we found that households with three children faced an effective marginal tax rate of 102.9%. The interaction between the withdrawal of Child Benefit and Universal Credit together meant they would lose money for earning more, in contrast to the work incentives UC aspires to create.

In Chart 4, below, the family would face an effective tax rate of 73.9% due to the HICBC threshold rise.

While this substantial fall in their effective marginal tax rate is welcomed, 73.9% is still too high, and it rises to 88.9% once Child Benefit begins to be withdrawn above £60,000. This is one of the main reasons for abolishing the High Income Child Benefit Charge altogether.

More can and should be done to make the tax and benefit system fairer and simpler

The tax cuts delivered in the Spring Budget will help people in work and improve work incentives. The reduction in national insurance contributions led to a 4 percentage point fall in effective marginal tax rates. When combined with the fall in the Universal Credit withdrawal rate from 63% to 55% announced in 2021, this means that people on Universal Credit get to keep more of their earned income.

Both of these measures improve work incentives for lower earners. However, for the same reason most of the gains go to families with higher earnings. This disparity falls at a time when people unable to work are seeing the cost of their essentials (food, utilities, rents) continue to rise faster than benefits.

Measures such as the extension of the household support fund, and an end to fees for people applying for a Debt Relief Order help people in crisis, but there are many more of these families today than there were a decade ago, and if the Chancellor wanted to protect the poorest families, he could have made different choices.

Similarly, while the changes to the High Income Child Benefit Charge are welcome, it still complicates the system for higher earners with children, and a child-centered policy penalises families with children at a time when all households are struggling, and children face the highest rates of poverty we have ever seen.

Frustratingly, the Chancellor’s changes to the HICBC failed to address the lone parent/dual parent gap and the new threshold now means that a lone parent earning £60,000 will be impacted before a dual-income household where both parents can earn a combined £120,000 before reaching the same benefit reductions. A statement from the Chancellor hinting toward HMRC collecting household income details would only complicate the tax system still further.

In our 2023 report, we also called for the government to remember to support people who are unable to work, and to end the savings limit in Universal Credit as well the HICBC altogether. Our advice is still that people should claim Child Benefit whatever their earnings, as even if Child Benefit is withdrawn, it helps to build National Insurance Credits.

Policy in Practice will continue to call for a simple and progressive benefit and tax system, that works for households both in and out of work. We’re glad to see our policy reports make a difference. This is an example where the DWP and HMRC aren’t working together to better design policy, there are other examples, including HMRC restrictions on how their data can be used to support Universal Credit recipients. We will continue to campaign to maximise support to households that need it.

Obvious policy flaws such as the HICBC should be the easiest areas for the government to address and we will continue to challenge the government when benefits are working against, not for, low income families. For families impacted, they should still claim Child Benefit, and be aware that even higher rate taxpayers, if they are renting and have childcare costs, may still be able to claim Universal Credit.