Managed migration to Universal Credit

All your questions answered

Frequently Asked

Questions

Managed migration is the process by which the Department for Work and Pensions (DWP) moves households to Universal Credit and ends their previous legacy claims. Households who are being moved over through the managed migration process will receive a migration notice informing them that their legacy benefits claims are ending and that they will have to claim Universal Credit.

These households may receive transitional protection if they are worse off under Universal Credit.

Universal Credit managed migration will be rolled out in all areas by March 2025.

Natural migration is when a household is moved to Universal Credit due to a natural change in circumstances which ends legacy benefits. This may be due to starting or ending work, a relationship change, a child growing up and moving out of the household, or moving house to a different local authority.

Households moving to Universal Credit through natural migration do not receive the same protection as if they moved through managed migration. Their claim for Universal Credit will be treated as a new Universal Credit claim.

Households concerned that a change in circumstances could lead to a move over to Universal Credit should seek specialist benefit advice

Legacy benefits include:

- Child Tax Credit

- Working Tax Credit

- Housing Benefit for working age people

- Income related Employment and Support Allowance (ESA)

- Income based Job Seekers Allowance (JSA)

- Income Support

Most households claiming legacy benefits will be moved to Universal Credit by the end of 2024. However, individuals receiving ESA without additional benefits or in addition to Housing Benefit only are going to be among the last to be moved over to Universal Credit. These households will move to Universal Credit from 2025.

There are multiple circumstances which can trigger an end to legacy benefit claims and a new claim to Universal Credit needed. For natural migration, these changes are often referred to as ‘changes in circumstances’, and relate to when a household’s circumstances have changed so that their benefit claim changes or ends.

Changes in circumstances can be:

- A change in housing situation, such as moving house to a different local authority

- A change to a household or family make up such as a relationship ending or beginning, or child growing up

- A large change in income

If you are worried about any changes in circumstances that could lead to your current legacy benefits claims ending or having to move over to Universal Credit, please seek specialist local benefit support.

The notice will be received from the DWP and may have an HMRC logo or, for Northern Ireland residents, a Department for Communities logo. It will always include a deadline date as well as informing you that your legacy benefits are ending.

You can choose to move to Universal Credit before you receive a migration notice. However, it is important to check if you are likely to be better off or worse off under Universal Credit. It is advisable to wait until you receive a migration notice with a specified deadline before taking any action if you may be worse off under Universal Credit. This is to ensure that you receive any “transitional protection” in your move over to Universal Credit.

Some households may be better off under Universal Credit. It may be beneficial to these households to move to Universal Credit before they receive their migration notice. However, it is important to understand all the implications of this move and the impact on budgeting.

Households can use the Better Off Calculator to see whether they will be better or worse off under Universal Credit. We recommend households seek advice if they are considering moving to Universal Credit voluntarily.

No, claimants moving over to Universal Credit will not automatically be moved. Once a household has received a migration notice they will need to manually make a claim for Universal Credit. This can either be an online application, or if this is not possible, this can be done over the phone.

Additional support with making the claim can be found at local advice centres or through the Citizens Advice “Help to Claim” service.

No, it is not possible to stay on legacy benefits and not migrate to Universal Credit. Working age households will need to move to Universal Credit.

However, some pension age households who retained legacy benefits rather than pension age benefits, will be able to move to Pension Credit. The DWP is aiming to move everyone to Universal Credit by 2025. It will then no longer operate legacy benefits.

Housing Benefit will remain for pension age households and households in support or temporary accommodation.

If no claim is made for Universal Credit following a migration notice households will no longer receive any benefit support.

Some households who are currently claiming legacy benefits will receive less under Universal Credit than they currently receive on their legacy benefits. If a household claims Universal Credit before the deadline on their migration notice they will receive an amount within their initial Universal Credit payment which increases their Universal Credit award to legacy benefit levels. This is called the transitional protection element.

This transitional protection element is not permanent and will reduce over time as circumstances change and Universal Credit awards are uprated. It will decrease over time until it is no longer included in your award.

Households currently in receipt of Tax Credits may have savings that mean they would not normally be eligible for Universal Credit. These households will receive time limited transitional protection as savings above £16,000 will be disregarded for 12 months.

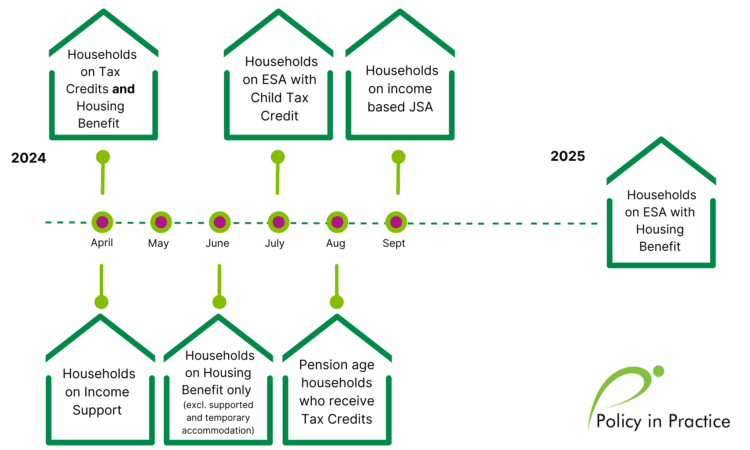

- People on Tax Credits only will be moved to Universal Credit from 2023 so may receive a notice any time

- People on Income Support or households in receipt of both Tax Credits and Housing Benefit will receive notices from April 2024. Notices are likely to continue until June 2024

- People on Housing Benefit only will be moved to Universal Credit from June 2024. However, households who are in supported accommodation or temporary accommodation will not receive a notice and their Housing Benefit claim will continue

- People claiming Employment and Support Allowance (ESA) with Child Tax Credit will be moved to Universal Credit from July 2024

- People on income based Jobseekers Allowance (JSA) will be moved to Universal Credit from September 2024.

- Pension age households who receive Tax Credits will be moved to Universal Credit or Pension Credit from August 2024

- People on Employment and Support Allowance (ESA) with Housing Benefit will move to Universal Credit from 2025.

People who are pension age and in a mixed age household will still be moved over to Universal Credit. A mixed age household is where one member of a couple is over pension age and one is under pension age.

They will have to claim Universal Credit as a working couple, but only the working age member of the couple will have to work and complete work related tasks if they do not have a health condition affecting their ability to work or look for work.

Mixed age couples will be moved over to Universal Credit from their legacy benefits but the timescales surrounding this are currently not certain with further information to be released by the DWP in the future.

Legacy benefit claims will also end for pension age households as they are encouraged to claim Pension Credit. The Better Off Calculator can be used to check eligibility for Pension Credit and other support.

For households who are currently claiming council tax reduction with their legacy benefits, they may have to re claim this when they move over to Universal Credit. Although when a claim is made for Universal Credit, this can be taken as a claim in some Local Authorities, households should always check with their local council that a claim has been made and their reduction will continue.

Sometimes, if a household does not claim council tax reduction when they move over to Universal Credit, then the reduction on their bill can stop and this may mean that your bill could increase drastically depending on your discount and you could also fall into council tax arrears without knowing. Households should confirm with their local council that their reduction is continuing.

For people who are self employed, the process of moving over to Universal Credit will be the same as people who are employed. However, people who are self employed will have a different relationship with Universal Credit than their previous legacy benefits, such as tax credits.

For the first 12 months of someone who is self employed moving over to Universal Credit, they will receive “transitional protection”. This will be that you receive a “top up” to your Universal Credit award if this is less than you were receiving in your legacy award, or any savings that you have over £16,000 are disregarded.

However, you will also receive protection from something called the minimum income floor for 12 months from when you move over to Universal Credit. The minimum income floor is a level of income that the DWP expects people who are self employed to earn. If you are self employed and earn less than this, then the DWP will calculate your Universal Credit award as if you earned this level of income.

The minimum income floor is normally calculated by multiplying the number of hours that you are expected to work by the minimum wage.

The main difference between a Universal Credit claim and a previous legacy benefit claim will be the relationship between yourself and the work coach, as well as how the benefit claim is calculated.

For example, most Universal Credit claims are made online through the Universal Credit portal where you will be able to see your award, how this is calculated, and message your work coach. You will also be able to see your next actions, meetings and other information here.

Furthermore, through Universal Credit, you will also have a much closer relationship with the DWP and your work coach. This is mainly through the conditionality that you are under through your claim. This conditionality is the actions that you must take in order to receive your benefit payments and for your claim to continue. This may mean that you have to attend more meetings with your work coach, or do more activities in order to receive your payments.

The Universal Credit system also means that the DWP has a greater ability to amend your payments and can make deductions from your Universal Credit payments. These deductions can be for sanctions where you are judged to have not met some of the conditions of your claim, such as a job centre appointment, or for debts. These debt deductions can either be for historic overpayments for a household’s previous legacy benefit claim, or to third parties for other debts, such as energy debt or rent arrears. There is a limit on the level of deductions that you can receive and you can negotiate if you find the deductions too much.

If you move over to Universal Credit and receive a deduction which makes your award lower than you can afford to live on, then please seek specialist benefit advice to help you negotiate this to an affordable level.

If you receive any of the following legacy benefits, or a combination of them, the steps to take are set out below.

- Housing Benefit

- Income based Jobseeker’s Allowance (JSA)

- Child Tax Credits (CTC)

- Working Tax Credits (WTC)

- Income Support (IS)

Step 1: Before receiving your migration notice

Before you receive your migration notice, check to see if you are better off or worse off under Universal Credit. Use our Better Off Calculator to see what will happen to your benefits. For more complex cases, reach out to local support services if you need any additional help.

If you are worse off under Universal Credit, or do not want to move over to Universal Credit until you have to, then you should wait for your migration notice.

If you are better off under Universal Credit, it may be better to move over to Universal Credit before receiving your migration notice as this may increase your income. You are advised to seek further advice before doing so to ensure you are fully aware of the implications.

Step 2: Ensure your Tax Credit award is up to date

If you have decided to wait until you are moved over to Universal Credit through managed migration and you are receiving Tax Credits, then you should ensure that you have contacted HMRC to inform them if you have had a change in circumstances or change in earnings.

This is to ensure that your award is as accurate as possible when moving over to Universal Credit to allow Transitional Protection to be calculated and also to protect you from overpayment and future deductions from a Universal Credit award.

Step 3: Wait for your migration notice

If you have checked your eligibility for Universal Credit and wish to wait to move over then you should wait for your migration notice.

It is essential that if you are worse off under Universal Credit or have a level of savings that would otherwise make you ineligible for Universal Credit that you wait for the migration notice. This will give you protection in your move over to Universal Credit.

If you receive your migration notice before April 2025 and the migration date is after April 2025, then it may be better to wait until after this date. This protects any transitional protection that may be eroded through the annual uprating of benefits in April 2025.

If you are unsure about how to move over or if you are unsure if you have received a migration notice then please contact a local advice agency, such as Citizens Advice.

Step 4: Claim Universal Credit

If you have checked that you have received a migration notice, and have checked that you are moving over at the best time, then you can claim Universal Credit. You can do this through two different avenues:

- Online: https://www.gov.uk/universal-credit/how-to-claim

- By phone on the Universal Credit helpline: 0800 328 5644

However, please be aware that if you claim by phone then you must continue to claim via the phone and cannot access your claim online.

If you are unsure about this, please check with local advice services such as Citizens Advice.