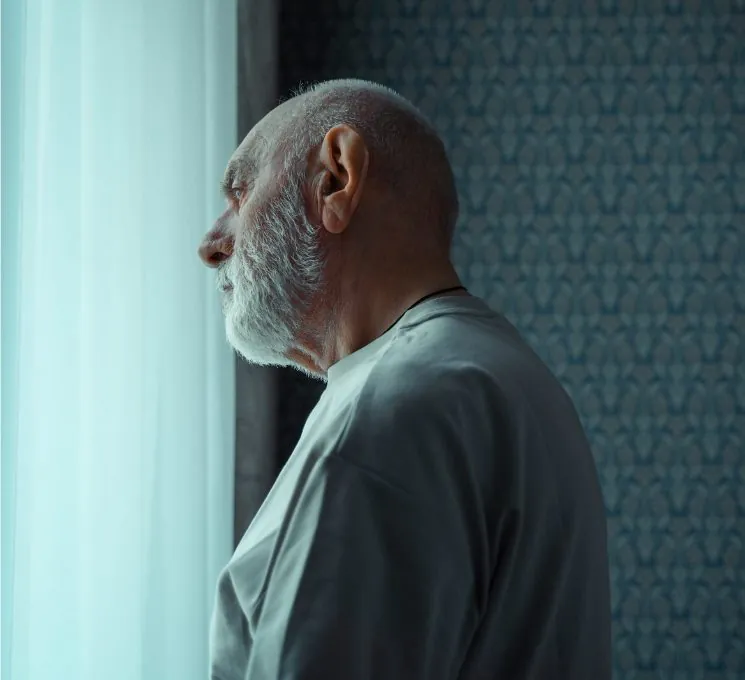

How data made London’s pensioners better off by over £8 million

25 October 2023

Pension Credit worth over £1.7 billion is unclaimed by nearly a million pensioners across the UK each year. In the capital, this figure is estimated to be £246 million.

In a campaign backed by the Mayor of London, data has been used to identify people who are eligible yet missing out on support worth thousands of pounds to a household each year.

The campaign saw 8,200 eligible older Londoners in 17 boroughs receive targeted letters to make them aware that they could claim this benefit.

So far, 2,165 have claimed an average of £3,879 in unclaimed Pension Credit, amounting to just under £8.4 million. The scheme is now being extended to include up to 23 boroughs. It will target over 10,000 more Londoners and could see an additional £9 million of Pension Credit claimed.

Councillor Claire Holland, Executive Member for Communities at London Councils, the local government association for Greater London, said “This campaign is a great example of what can be achieved through collaboration and intelligent use of data.”

Deven Ghelani, Director of Policy in Practice, said “The results in London are easily replicable across the country.”

Policy in Practice published analysis earlier this year finding that the total amount of unclaimed income-related benefits and social tariffs in the UK is £18.7 billion a year, and put this down to issues such as administrative complexity, lack of awareness, and stigma that can be attached to claiming benefits.

Listen back to hear

- Understanding the context: unclaimed benefits nationwide and in the capital

- The Greater London Authority’s work to tackle poverty in London

- Pension Credit take up campaign: how data was key to the impact achieved

- Lambeth Council’s activity and results

- The campaign results and next steps

Guest speakers

In London, we've been working with Policy in Practice to scale up an approach to Pension Credit uptake and up to this point, about 1,700 successful claims have been made. Pension Credit within London is around £3800 per claim, which is obviously a significant amount of money.

Our research suggests that there's a significant link between poverty and child welfare. This means that the impact of the cost of living crisis is also likely to have an impact on other areas as well. My experience over the last 12 months demonstrates the benefits of bringing all this data together to assist safeguarding practices, that's why we're focusing on building MAST to scale across regions around the country.

We announced a Cost of Living Response Plan '23/'24, focusing on responding to urgent need, minimising costs, maximising income, building financial resilience and managing debt. We feel very passionate about building financial resilience for our residents. 349 households have now received Pension Credit. That's about £13.2 million going into their pockets.