The Fraud, Error and Recovery Bill: A fresh approach to fraud or fuel for stigma?

The DWP has unveiled plans to recover benefit fraud overpayments by directly accessing people’s bank accounts, new powers of search and seizure for the DWP, and driving bans, all controversial proposals within the Public Authorities (Fraud, Error and Recovery) Bill.

As the government releases details of these new powers, it faces increased pressures to bring down the welfare budget and get public spending under control.

The social security system in the UK currently costs around £320 billion a year, an amount just shy of 25% of all public spending. This eye watering figure makes it easy to see why welfare expenditure regularly hits the headlines and why it is a prime target for cuts when public spending has to be reduced.

Tackling fraud and error in the system gives the public assurance that our money is being well managed and that people who take advantage of the system are held accountable.

However, debates about fraud and overpayments often dominate the conversation, overshadowing more significant issues such as unclaimed benefits, unfulfilled eligibility, and systemic barriers to access.

In this blog we reflect on recent developments in welfare fraud policy and why a balanced approach, better use of data, and stigma free narratives are crucial to achieving a fairer, more effective social security system.

Stigma: The real cost of benefit fraud

Once we strip away costs for pensioners such as the State Pension (a whopping 55% of welfare expenditure), the UK will spend close to £140 billion this year on working age benefits, support for children, disabled people, and people with health conditions.

So how much of this is legitimate and how much is fraudulent?

Official figures can be tricky to navigate as groups of recipients and benefit types often overlap and, over the last few years, the DWP has changed its methodology to separate fraud and error in its reporting.

However, in the financial year 2023/24, fraud accounted for an estimated £7.4 billion, or 2.8%, of total social security expenditure.

This level of fraud means that for every £1 we spend supporting people who need it, including huge areas of spending such as the State Pension, around 3p is claimed fraudulently.

Given the size of the welfare bill, fraud in the welfare system must always be tackled, yet a relentless focus on it risks reinforcing stereotypes and deterring genuine claims. Addressing fraud is important, but it should not come at the expense of fairness and dignity. And it appears that the Government’s plans will not be enough.

Labour’s fraud plan addresses less than 5% of debt

New measures aimed at recovering welfare fraud outline a plan to recoup £1.5 billion claimed fraudulently over the next five years. This plan includes investing more than £600 million over three years to modernise fraud detection systems, improve data analytics, and hire some 1,400 additional investigators. While this commitment demonstrates a serious intent to tackle fraud, it also raises questions about the balance of priorities.

Putting these numbers into context, recovery ambitions of £1.6 billion equates to approximately £0.3 billion per year, or 4.7% of the estimated annual fraud total. Factoring in the investment cost, net recovery during the first three years will be significantly lower, highlighting the need for these measures to deliver long term value.

These numbers illustrate that while fraud recovery is important, it is not the silver bullet for improving the welfare system’s efficiency and let’s face it, no system is airtight. A broader approach is needed to address the underlying causes of welfare expenditure and ensure the system is working as intended.

Tackling debt at source using open banking

The Fraud, Error and Recovery Bill includes a potentially concerning proposal for banks and building societies to “flag where there is an indication that there may be a breach of eligibility rules for benefits” with the Government’s brief adding that this “prevent debts accruing”.

As with most legislative proposals, the devil is in the details, and so far this measure is being pitched for cases where there is suspicion or evidence of fraudulently breaching eligibility rules.

This proposal to recover fraudulent overpayments of benefits from bank accounts is bold but not without precedent. Recovery of other debts such as unpaid Council Tax can be deducted directly from pay packets, taken from ongoing benefits, and even forced bankruptcy or the sale of a home.

Recovering money from source exists, and if retrieving overpayments from bank accounts is as impactful as the lead up to the Fraud, Error, and Debt Bill would have us believe, we may see it transition to other areas of public revenue collection.

In the meantime, yes, we should minimise fraud, and yes, fraudulent claims are spoiling the system for the 97% of ‘genuine’ benefit claims. But when we focus on fraud we fuel deeply ingrained beliefs about ‘benefit cheats’ and detract from the millions of households that are rightfully and legitimately supported by a social safety net designed to be there for all of us when we need it.

Instead of cheats and scroungers, we should talk more about the millions of families who are missing out on support each year, many of whom cannot overcome the stigma associated with claiming.

Unclaimed and underclaimed benefits are the bigger issue

Our research tells us at least £23 billion in benefits and support goes unclaimed each year, and in addition to fraud statistics, the DWP also reports on unfulfilled eligibility, some £3 billion in underpaid claims.

Billions of pounds going unclaimed each year leaves vulnerable people without the support they need and can claim by right.

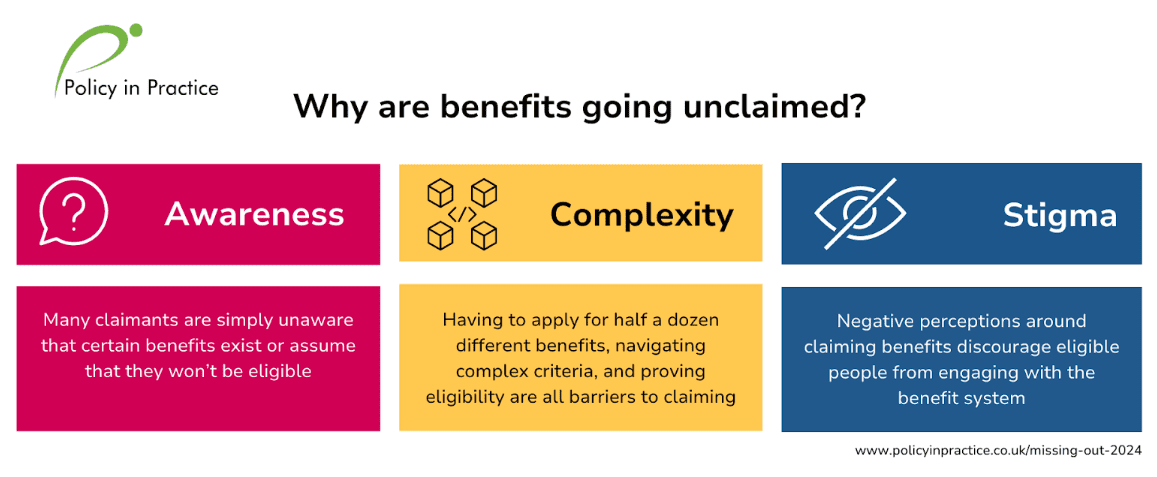

Sadly, this gap is not a failure of individual claimants but a systemic issue caused by complexity, stigma, and lack of awareness.

To address this unacceptable gap in financial support, we need proactive outreach, simplified application processes, and public education campaigns to normalise accessing benefits.

These steps would not only reduce hardship but should also increase economic activity as more people receive the help they need.

The welfare system must balance fraud prevention with fairness and support. While no system is perfect, modernising processes, reducing stigma, and tackling unfulfilled eligibility are essential steps.

Here’s what a balanced approach could look like:

- Reducing unfulfilled eligibility and closing the unclaimed benefits gap

- Proactively reaching out to individuals likely to be eligible for support and then supporting them to make a claim, or update their circumstances to maximise their claims, will go a long way towards reducing shame and stigma, and is likely to deliver both health and local economic benefits in turn.

- Simplifying the application processes to make the system more accessible, or even going as far as to make proactive awards would reduce the digital divide and again, help people to see that financial support is a right, not something we should see as a personal failure.

Fraud recovery is important to maintaining public confidence in the welfare system but should not dominate the conversation. By addressing unfulfilled eligibility, reducing stigma, and tackling the root causes of welfare dependency, we can build a system that is fair, efficient, and supportive. Welfare reform is not just about saving money, it’s about empowering people to lead secure and dignified lives.

Join our webinar: Navigating the debt landscape in 2025: Emerging challenges and support strategies

Wednesday 29 January from 10.30 to 11.45

As we enter 2025 many families will be feeling the effects of Christmas spending on top of the cost of living crisis, rising inflation and higher interest rates. These existing pressures add to festive debt, further stretching household budgets, and many people are turning to credit to cover essential costs.

Unsecured debts like credit cards, personal loans, and buy now pay later schemes are becoming more common, and some households are falling into a cycle of high interest borrowing that only worsens their financial situation.

At the same time, a major issue is the £23 billion in unclaimed benefits and support that could help struggling families. Many people are unaware of the help available to them, and this gap in access to support remains a significant problem.

This webinar will explore the key financial challenges facing households in 2025, and how organisations are responding to help people before they reach a crisis.

We’ll discuss how frontline services can identify vulnerable people early and provide timely support. We’ll also explore how technology and data-driven solutions are helping organisations better engage with people, ensuring they get the right help at the right time.

Join us to learn:

- Key trends in debt in 2025 and the emerging challenges for households

- The role of frontline services in providing early support to prevent long term financial harm

- How organisations are using technology and data to engage vulnerable customers and close the support gap

- Best practices for identifying unclaimed support and ensuring that people get the help they need

With guest speakers: Vanessa Northam, StepChange, Nick Harvey, Folkestone and Hythe District Council and Jonathan Shaw, Reachout