New analysis: How data can improve access to social tariffs in the short and medium term

Rising bills, unclaimed support: The urgent need to fix social tariffs

With the cost of essential services rising sharply, water bills alone are projected to increase by up to 47% from April 2025 and millions of households are struggling to cope. Yet across the UK, 8 million families are missing out on £3 billion worth of social tariffs that are specifically designed to ease the burden of energy, water and broadband bills.

With household budgets under increasing pressure, it’s unacceptable that support is left unclaimed due to avoidable barriers.

Social tariffs offer crucial financial relief by reducing utility bills for eligible low income households. However, traditional outreach and application methods leave many people unaware, deterred by complexity, or reluctant to claim due to stigma.

The good news is that innovative approaches using targeted data and automated processes are proving that access to these essential discounts doesn’t need to be this difficult.

A new study funded by abrdn Financial Fairness Trust, released today, highlights four pioneering utilities that are successfully using data and automation to remove these barriers. Their impact demonstrates that these proven approaches can and should be scaled nationwide, ensuring that millions of households receive the support they urgently need.

Leading utility companies are showing the benefits of data sharing to support auto enrolment and streamlined assessments. The government can take action today that makes straightforward access to social tariffs and bill support the core and expected response from utility companies to customers facing affordability issues.

Deven Ghelani talks to Vanessa Feltz, LBC, about rising utility bills and unclaimed social tariffs on Saturday 27 March 2025

Art of the possible: Findings

The Art of the possible report by Policy in Practice profiles pioneering companies that are already using data to increase take up of social tariffs. The findings show that rapid progress can be made today with existing data driven tools and sets out the steps and requirements for scaling these proven innovations. The report explores the feasibility of a single national water social tariff and what needs to happen to make it a reality.

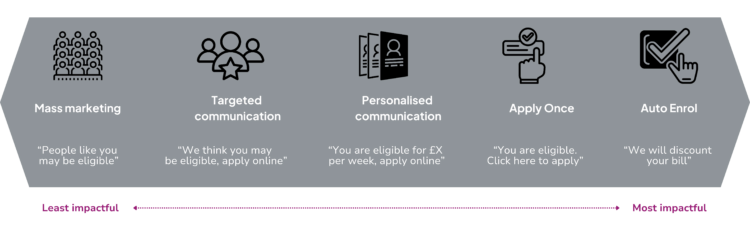

- Pioneering utilities are using innovative data led approaches like Auto Enrol and Apply Once, as well as targeted communications, to remove barriers that prevent customers from taking up social tariffs and other support

- Case studies from these innovative utilities, shown below, show that the necessary data sharing infrastructure and legal gateways are largely already in place

- All three approaches to increasing take up, Auto Enrol, Apply Once and targeted communications, are more impactful than traditional mass marketing awareness campaigns. Auto Enrol is the most impactful as a model of automation that can and should be built on as evidenced with Warm Home Discount delivering energy support automatically to the vast majority of eligible households (92% in 2023-24)

- However, the three approaches work best in tandem. Auto Enrol is highly effective but relies on DWP benefits data, therefore missing the millions of people in need of support who are outside of the benefit system. Apply Once and targeted communications are essential for streamlining the application processes for consumers who are not covered by automatic schemes. They also increase the take up of passported benefits which, in turn, grant access to other support

- The case studies show that even complex scheme criteria can be automated, but successful automation depends on designing schemes that use readily available data.

Case study: South West Water and its Water Poverty Tool

The problem: South West Water (SWW) aims to eradicate water poverty in the South West. SWW has to be efficient given the already high costs of serving a sparse coastal population. Its offer includes efficiency measures, smart meters, debt support and a 15-85% off WaterCare tariff. Like all water companies, awareness of support was low. Brett Conibere, Head of Customer Insight, Support Services and Metering said: “We cannot wait for people to come to us”.

What they did: SWW partnered with CACI, an analytics company, to build a high resolution view of estimated water affordability down to groups as small as 12 households. SWW segmented customers, offering efficiency measures and smart meters where that was enough to bring them out of water poverty, and providing additional support like their WaterCare tariff where it was needed.

Behind the scenes: Technically, SWW and CACI combined several data sets, including matching SWW’s billing data and CACI’s Ocean data set (which draws on Electoral Roll, research surveys, open data, government data and other sources) at postcode level, along with other data sets like OBR’s income forecasts, to estimate water poverty at household level. To enrol customers onto social tariffs, benefit receipt was checked with DWP through an API. Legally, CACI’s data is aggregated facing fewer data governance hurdles. DWP’s API relies on the Digital Economy Act Section 38 to assist people in water poverty.

Impact on customers: By the end of 2024, SWW has helped over 1,000 customers with water efficiency measures and over 2,000 with smart meters, on top of the 26,000 customers enrolled onto WaterCare. And this is only the beginning: by 2030, SWW plans to have supported 1 in 10 customers with water efficiency measures.

Impact on the utility: SWW found customers more willing to engage in other support when coupled with financial support. Despite the cost of living crisis, SWW’s commitment to aiding and supporting customers struggling with debt has decreased its doubtful debt charge by 45% from £16 million in 2012-13 to £8 million in 2023-24.

Case study: Anglian Water and Apply Once

The problem: Anglian Water introduced LITE and Extra LITE tariffs to support customers with low disposable incomes who were struggling to pay their water bills, but many eligible customers were not accessing the tariff.

What they did: Anglian Water integrated its processes with the GOV.UK endorsed the Better Off Calculator allowing their customers to sign up to the right social tariff with a couple of clicks, rather than having to start all over again on the Anglian Water website and complete the additional paperwork required for the old process.

Behind the scenes: Technically, the Better Off Calculator calculated the customers’ eligibility and identified the correct social tariff, displaying it only to eligible customers. Anglian Water has adopted the calculator as its primary application form for social tariffs, meaning the customer’s data could seamlessly be ported through. Anglian Water verifies the customer’s benefit claim with DWP through an API. Legally, the data sharing was straightforward as users consented to the use of their data for the application.

Impact on customers: Over the last 12 months, over 60,000 customers have used the calculator to assess eligibility as part of Anglian’s sign up journey online, over the phone or via support services. Many first learn about Anglian’s social tariff through the Calculator and go on to apply, with over 2,800 doing so immediately through ‘Apply Once. ’ Already 5-10% and potentially 15-30% of applications. Others will apply later after claiming more valuable benefits like Universal Credit. This shows the benefit of having the social tariff in a benefits calculator used by over 2 million people annually. The Calculator has also helped people access other benefits, with nearly 12,000 customers helped to access £9.4 million of additional support.

Impact on the utility: Anglian Water saved money, reducing manual processing costs and improving customer satisfaction.

Case study: Thames Water and Auto Enrol

The problem: Thames Water (TW) has enhanced its WaterHelp tariff to better support customers in need through the cost of living crisis. TW is keen to exceed the regulator’s targets for social tariff take up and to reach the customers most in need, yet faces low customer awareness despite extensive outreach, with many customers experiencing digital, disability and language barriers. Previous attempts to automate using DWP’s matching service were not fine grained enough, providing only yes/no responses for benefits receipt.

What they are doing: Thames Water is piloting with two London boroughs and Policy in Practice to automatically assess low income customers in water arrears for WaterHelp eligibility. TW expects to automatically enrol over 1,200 eligible customers onto WaterHelp, increasing to 2,500 in April as tariff increases take effect. This replaces traditional mass marketing efforts and a manual application journey which places the onus on the customer to be aware of the tariff and to then complete an application.

Behind the scenes: Technically, multiple benefits and administrative datasets from DWP and local authorities (LAs) were matched by Policy in Practice at the household level. The data is then analysed to calculate water poverty and assess eligibility against Thames Water’s criteria. To maintain data privacy, Policy in Practice acted as a trusted third party, matching LA data to TW’s customer records and flagging eligible customers, meaning TW never received customer data. Legally, the data sharing was possible under the Digital Economy Act section 38 and section 38 provisions for Water Poverty, with GDPR’s minimisation and proportionality achieved by adopting the trusted third party model.

Impact on customers: Over 1,200 customers are expected to be enrolled from April 2025, doubling enrolment and distributing an estimated £500,000 over a year without having to go through a 30 minute income and expenditure assessment. 600 customers were found to be in both water arrears and council tax arrears and will receive additional support by the council. The approach is planned to scale to other local authorities across the Thames Water region.

Impact on the utility: Thames Water expects to reach customers in financial hardship while saving administration costs as it scales this programme across London.

Case study: British Gas Energy Trust and Debt Relief

The problem: British Gas Energy Trust (the Trust) provides grants to customers with energy debt. The Trust relied on self-referrals and referrals from frontline services, services which struggled to stay abreast of various schemes’ eligibility requirements. This meant that despite the cost of living crisis, funds were often underspent. For self-referred customers, the process was disjointed as they had to use another website and re-enter their details.

What they did: The Trust integrated its eligibility assessment with the Better Off Calculator, endorsed by GOV.UK and used by advisors and the public nationwide, meaning customers are assessed for the grant as part of their advice journey. The Trust also integrated the Better Off Calculator on their website to allow customers to apply for debt relief online and to check for unclaimed benefits as part of the one process.

Behind the scenes: Technically, Policy In Practice implemented the Trust’s different eligibility requirements and assessed customers while they used the calculator. The Trust could then turn schemes on and off depending on funding availability. The Trust integrated the calculator with their website, using a ‘white labelled’ version of the calculator which transferred the applicant’s details via API to prefill their application form. Legally, the data is processed with the customer’s consent.

Impact on customers: Of over 2 million customers a year who use the Better Off Calculator, more than 80,000 customers between April and September 2024 were assessed as eligible for the Trust’s support scheme, many of whom went on to apply, of which over 5,000 applied immediately using Apply Once. Others will have applied over the phone or after they have claimed more valuable benefits like Universal Credit. Customers’ journeys were streamlined and they didn’t have to re-enter their details.

Impact on the fund: The Trust has been able to reliably disburse its funding with confidence its support is reaching the most in need. By integrating with the Better Off Calculator, the Trust has simplified the client journey by combining advice and application into one step, ensuring customers in debt have been supported to access unclaimed benefits to prevent debt build up in the future. The integrated journey has also reduced administration costs.

Data driven approaches to social tariffs take up deliver greater impact

Traditional mass marketing techniques have failed to raise awareness much above 30%. Pioneering utilities are showing the power of data driven approaches, particularly:

- Targeted communication: Proactively identifies and directly informs customers of their eligibility to support via personalised outreach that significantly improves take up

- Apply Once: Simplifies the process by embedding social tariff applications into commonly used benefits calculators, removing duplication and complexity

- Auto Enrol: Automatically enrols eligible customers onto social tariffs using government data, removing the need for manual applications entirely

Linking these approaches to local provision could shift support from being purely transactional to truly transformational, not only reducing bills and administrative costs but also addressing broader financial challenges in the household. Simply providing social tariffs won’t guarantee that someone can pay their water bill; if their household budget remains in deficit, debts will continue to grow, and utility bills will remain a lower priority.

Unlocking the potential of data sharing to boost social tariffs take up

Current data protection laws, such as the Digital Economy Act, provide a solid framework for data sharing to deliver these innovations. Specifically, legal gateways like sections 35, 36, 37, 38 and 39 explicitly allow data sharing between public authorities and utilities, enabling the identification and support of households facing water and fuel poverty.

Social tariff schemes must be designed with criteria that can be automated using existing data. While these criteria can still be quite sophisticated, as demonstrated by the Thames Water Auto Enrol pilot for its WaterHelp social tariff, automation is key to scalability.

The Warm Home Discount offers both a positive and negative example. When the policy was redesigned for automation it enabled an increase in take up to 92% of eligible recipients. Future national water social tariffs and Warm Home Discount schemes should be designed from the outset with automation as a core requirement.

Art of the possible: Recommendations

The vision must be a national water social tariff with automatic enrolment for people known to be eligible and in need by April 2026. To make progress towards that vision and to support take up of all social tariffs we make the following recommendations

Three actions that should happen today

With water bills set to rise by an average of 26%, and up to 47% in some cases, urgent action is required. There are clear, tangible opportunities that would have a rapid impact nationwide

- All water and energy and broadband companies implement Apply Once with the GOV.UK endorsed benefits calculators

- Water companies pilot Auto Enrol for customers in arrears

- Targeted take up campaigns executed for water and broadband social tariffs and passporting benefits like Universal Credit and Pension Credit

Two actions that should happen by April 2026

Automatic enrolment is critical for social tariff uptake. A national water social tariff and any redesigned Warm Home Discount scheme should be designed to use existing data. We need to plug as many gaps in the system as we can to improve families’ financial stability. We therefore recommend:

- Implementing a national, automatically enrollable water social tariff

- Plugging the gaps in the system by reviewing WaterSure, the Warm Home Discount and broadband social tariffs

Four years into the cost of living crisis it's wrong that eight million households are still missing out on vital support for the everyday essentials of life. Every water, energy and broadband company should do what Anglian, Thames Water, British Gas Energy Trust and South West Water already do - or explain why not.