Budget 2025: What does it mean for low income households?

After weeks of leaks, Budget 2025 contained no surprises, other than the OBR accidentally publishing its report 40 minutes before the Chancellor stood up.

The lifting of the two child limit was its flagship policy, alongside a mix of tax fudges largely aimed at the better off.

The Chancellor promised a Budget to raise living standards. For children in poverty, she delivered. Circumstances can suddenly change for any of us – the Chancellor was right that no child should bear the cost, simply for being born into a larger family.

But there was relatively little to boost living standards for other low income households. Instead, the impact of frozen thresholds continues to build. More households will find their overall support capped. People will still find it hard to pay their housing costs and will be paying more tax in real terms. Rising bills will put more pressure on household incomes, and on local services and discretionary support.

– Rebecca McDonald, Head of Policy, Policy in Practice

As ever, the complexity of the welfare system means working out the true impact of the Budget isn’t straightforward. In this blog we set out main takeaways we think you need to know.

This budget will reduce child poverty

The big news is the end of the two child limit. For the 17% of low income families with children who currently lose out, this will be a huge relief. It’s estimated that around 450,000 children will be pulled out of poverty.

What is the ‘Two Child Limit and the Benefit Cap?

What’s mostly forgotten, is that 1 in 5 families won’t receive the full benefit of this policy change. That’s because there’s a second cap – the benefit cap which limits the overall support a household can receive. Half of these families will get part of the extra child support, and the other half won’t get anything as they are already capped.

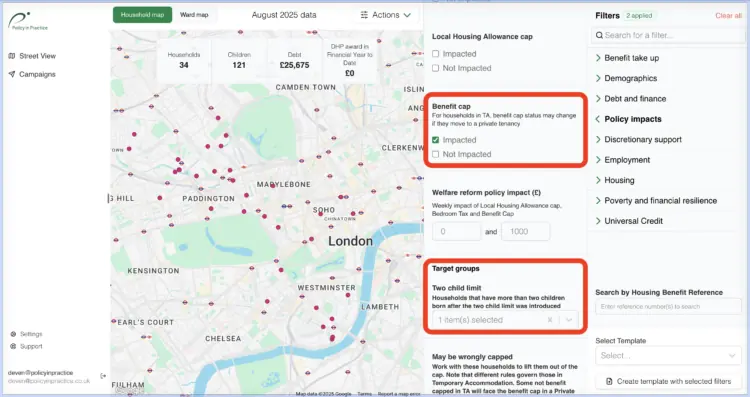

Local authority partners who use our LIFT platform are able to see which of their residents will benefit from the removal of the two child limit

Two more specific impacts are worth diving into:

- The implications differ slightly in Scotland. The Scottish Government was already planning to mitigate the impact of the two child limit from March next year through an additional payment, meaning some of the child poverty reductions would have happened without this budget. Now the cost will fall on Westminster instead, meaning the Scottish Government saves £155m it could choose to spend on other initiatives

- Increases in Universal Credit income could lead to reductions in other support for some families. For example, CTR schemes that use the Maximum Universal Credit Award as Applicable Income for CTR assessment purposes will see this rise, versus councils that have the two-child limit written into local regulations. This could tip a household across the threshold for having their council tax support reduced depending on the design of their local scheme

Young workers will get a pay rise

Next year’s minimum wage rates were confirmed today and younger workers on low incomes will get a sizeable pay boost in April. While the main rate (for 21 and over) will rise by 4.1%, 18 to 20 year olds will get an 8.5% pay rise, and there’s a 6% boost for 16 or 17 year olds. This marks a shift towards equalisation, something Labour promised in their pre-election manifesto.

But, there’s a risk this could weaken the job market for younger workers, if employers adjust to the higher cost or recruit more experienced workers instead. Minimum wage setting is always a tricky balancing act, but the risks are particularly high this year given an already growing rate of NEETs.

More low income families in work will be drawn into paying tax

Working households face a hidden cost from the extension of tax threshold freezes until 2031. Rather than end in 2028, thresholds will fail to rise with inflation for another three years. With every year frozen the costs build, with tax contributions gradually rising and more low income households brought into paying tax for the first time.

Cost of living measures increase support for low income households:

- A continued commitment to the triple lock means the state pension will rise by 4.8% next April, comfortably above inflation (expected to be 3.5% this year, and 2.5% in 2026). The same increase will apply to Pension Credit, meaning low income pensioners will benefit from a real-terms boost in support

- Energy bills will be reduced by shifting the cost of environmental schemes away from consumers and into their pockets. We expect the gain will feed through to low income households though the level of reduction may vary from the average £150 stated by the Chancellor. This – combined with the expanded Warm Homes discount – should make a material difference to many struggling to pay their energy bills

- The previously announced increase in the Universal Credit standard allowance will also take place next April. It will rise by 2.4 percentage points above inflation (based on this September’s CPI), making it a more generous increase than for the state pension

- The expansion of Help to Save to carers and those with children is welcome news, encouraging people on low incomes to build financial resilience. Takeup is low at 20%, unsurprising given the high cost of living. Low-income families are too often struggling to stay on top of bills before having money to put aside

Failure to increase LHA rates puts extra pressure on local services:

Turning to housing, local housing allowance rates will not increase in April 2026. This again pushes the policy further from its intention to make housing affordable to people on low incomes. We know that restoring LHA to current rents in 2024 made a big difference for many.

Today’s announcement will instead mean more families in rent arrears next year and add pressure on the Crisis and Resilience Fund and homelessness services.

On a more positive note, a new earned income disregard will be introduced for people in supported housing and temporary accommodation, helping to ensure young people caught in both Universal Credit and Housing Benefit tapers will be able to keep more of their earnings upon moving into work.

We can help you to be proactive as these measures come into effect:

We are helping local authorities understand who will gain and who will continue to struggle financially. As councils plan ahead for the Crisis and Resilience Fund, we can help you proactively identify who needs this support the most.

We can help you understand how this Budget impacts your residents. Using our LIFT platform and Better Off Calculator you can identify households for whom, even after the Budget’s announcements, will still struggle to make ends meet.

Last year, our clients helped over 1 million people identify over £2 billion in unclaimed benefits using our tools. As you plan ahead for the new Crisis and Resilience Fund, our insights can ensure you know who needs this help the most.