Finance organisations

Support your vulnerable customers

Be regulator compliant in supporting vulnerable customers

Finance and debt organisations use the Better Off plaform to easily embed income maximisation into their customer journey and start to put £23 billion of unclaimed support into people's pockets

See which of your customers are missing out and engage them with targeted support using Better Off Score

Integrate our simple benefits API to quickly screen for benefits and improve your customer experience with Better Off Indicator

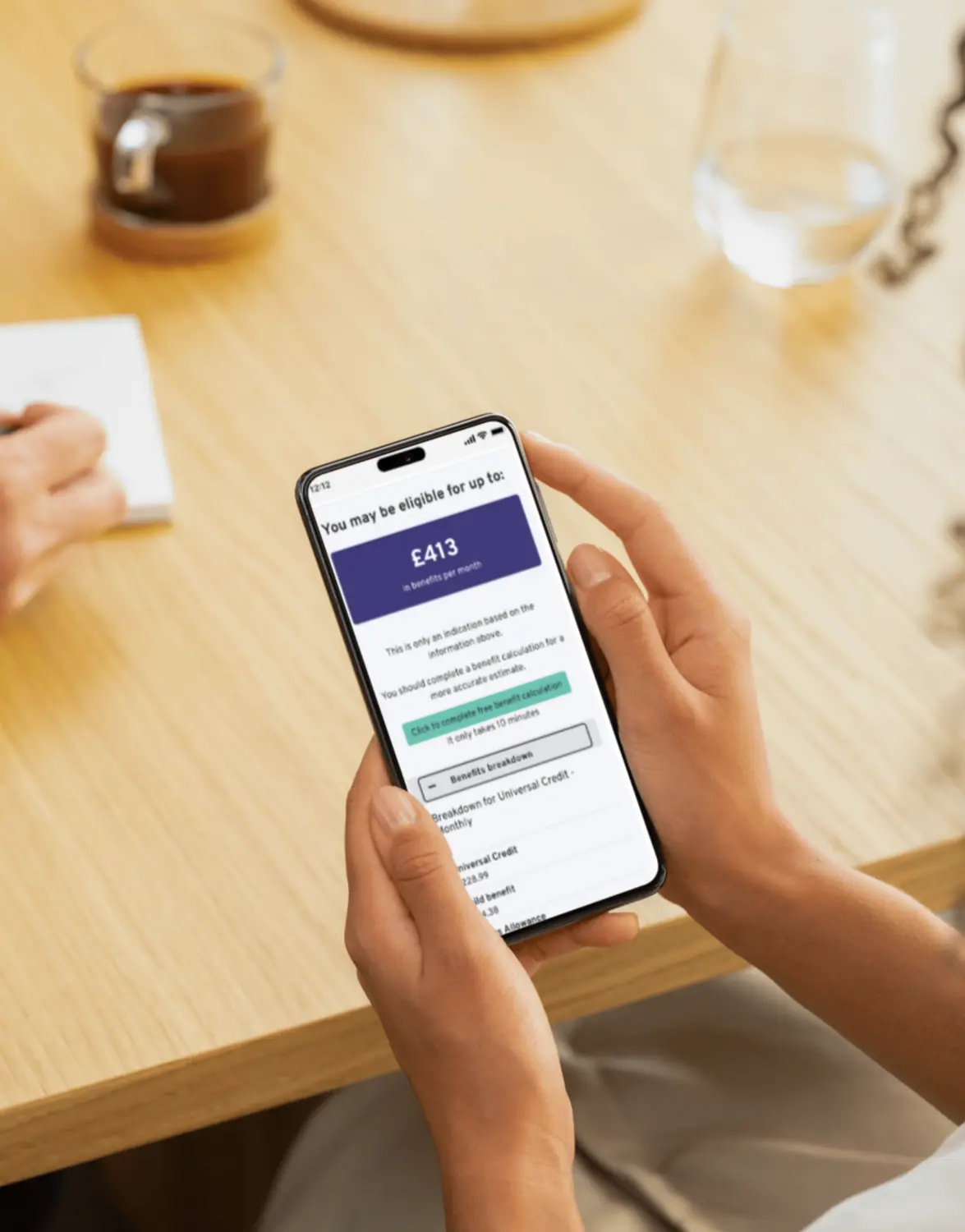

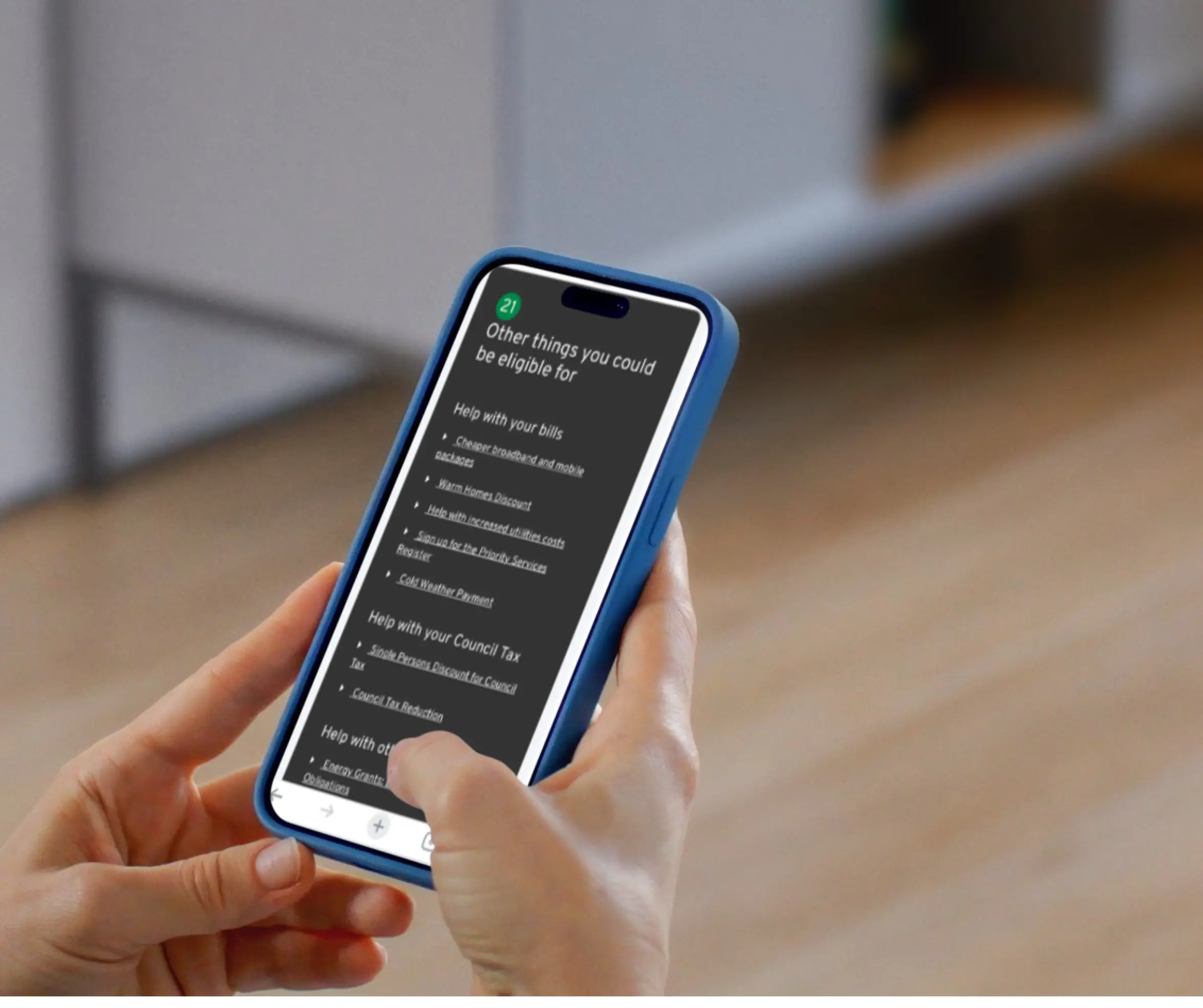

Self serve, embedded API and white label versions give customers and staff access to our comprehensive, accurate Better Off Calculator

Simplify benefit applications, significantly boost take up and reduce the time from application to receipt of benefits with Better Off Apply

How finance and debt organisations use the Better Off Calculator

Customer self serve

Get our self serve calculator so your customers can check their eligibility for benefits or prepare ahead for meeting an advisor

Target your support

Use Better Off Score to Identify which customers are likely to be missing out on benefits and proactively engage with those who will be better off the most first

Arrears and debt support

Use the Better Off Calculator to empower customers to check what support they’re eligible for and missing out on so they can optimise their income

Integrate income maximisation

Use our easy API to seamlessly integrate income maximisation into your existing Income and Expenditure journey to build financial resilience

Popular features

Book a call

Better Off Score

“The scale of success is absolutely phenomenal. We got 95% of our clients identified with potential for extra benefits and support, which was significant. On average we've unlocked a life enhancing amount of £583 per household per month. Some of our clients have really complex situations and low incomes; that amount of money is life changing.”

Better Off Indicator

“Providing a benefits check allows us to offer consumers within their journey something positive, in a time that is potentially very difficult. We're able to give something back as opposed to only be talking about taking stuff. We have a lot of dealings in the financial services space and this align to that consumer duty piece.”

Better Off Calculator

"Nationwide believes in fairer banking and good outcomes for all customers. An important part of this is enabling people to access the support they're entitled to in way that works for them. At a time when many households continue to experience financial hardship, we're incredibly proud that through our partnership with Policy in Practice, £1.2 million in unclaimed benefits has been uncovered for more than 2,200 people in the first four weeks since launch. As the first financial services organisation to launch a free telephone benefits calculator, this is a major forward in inclusive financial support."

Better Off Apply

“A lot of people are applying for loans for consolidation lending purposes and we'd love to see lenders and financial services doing more. We've been working closely with organisations like Policy in Practice to fund the integration of benefit calculators into lending journeys and because we know the drop off rates can be high when it's just a link on a website where it's hard to find.”

Common myths and questions

Book a free consultation

By submitting this form I confirm that I have read the privacy policy and agree to the processing of my personal data by Policy in Practice for the stated purposes. I can revoke my consent to this processing at any time